Consider that, since the start of 2015, Ohio has gained 227,000 jobs, according to the U.S. Bureau of Labor Statistics. The 3Cs accounted for 216,000 of those new jobs.

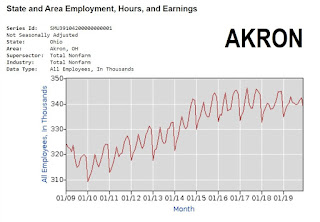

But it gets more compelling than that. If you add in the employment data from Ohio's next three largest metro areas -- Dayton, Toledo and Akron -- the employment in the state's six largest metro areas grew by 245,000 jobs.

In other words, Ohio would have lost 18,000 jobs in the last five years if it wasn't for Ohio's largest metro areas. It's safe to say that Ohio's six largest metro areas and especially its three largest are carrying the state's economy.

And the 3Cs are sustaining their near-decade-long momentum based on the job growth numbers displayed in the charts posted at the bottom of this article. I began to research that momentum when I wrote an article last month about Cleveland's documented $1.25 billion growth in individual taxable incomes since 2016.

But Cleveland's newfound job growth (after the prior decade's job losses) was doubled by that of Columbus and Cincinnati. All three cities are seeing billions of dollars of real estate investment pouring into their urban centers.

And it's not limited to their downtowns. Long-neglected neighborhoods like Cleveland's Hough, Cincinnati's Over-The-Rhine and Columbus' Olde Towne East are seeing investment unlike any era since the 19th century.

In contrast, Ohio's smaller metro areas, smaller cities and rural areas aren't doing as well as their big brothers. Their job growth has slowed, stopped or reversed course in recent years.

While demographers have coined the term "Fifth Migration" to describe the flood of Millennials and, to a lesser extent empty-nesters into America's larger urban centers since before the 2010s, it appears there is another demographic contributing to this ongoing migration pattern more recently.

The new urban migrant is the former small-town and rural resident who is fleeing conditions ranging from stagnant or declining job prospects, to the agglomeration of agribusiness, to the closing of small-town/rural hospitals, to the relatively poorer quality of Internet connections.

The Fifth Migration was detailed in a 2016 report by The Center for Population Dynamics at the Maxine Goodman Levin College of Urban Affairs at Cleveland State University (CSU).

To put this migration into context, the CSU report said the First Migration was the pioneers that settled North America; the Second Migration from farms to the factory towns; the Third Migration to the great metropolitan centers like Cleveland; and the Fourth Migration to the suburbs of these centers.

With the apparent movement of rural Ohioans to its larger cities (and to other cities nationwide), this migration pattern has much in common with the second and third migrations from the mid-1800s to the early 1900s.

Another factor in this migration pattern that has not been seen in past decades (at least, not since the early 1800s) is the movement of employers and residents from more expensive coastal cities to large, albeit less expensive cities in Ohio. NEOtrans documented this in articles in early 2018 and again in late 2018.

Ohio's declining small-city, small-town and rural employment situation along with its growing larger metro areas has some important political considerations locally, statewide and nationally as well.

While Cleveland has always been a center of strength for the Democratic Party, Columbus and Cincinnati were not. That is changing. Today, more Democrats are getting elected to municipal and county positions in Greater Columbus and Cincinnati.

But, as more rural residents move to Ohio larger cities, will these cities change the views of these new arrivals or will these migrants change the electorate's voting patterns in Ohio's larger cities? And it remains to be seen how these changes will affect statewide issues like gerrymandering, education and transportation investments or national matters like future presidential races.

Here is a summary of Ohio's employment situation, shown first in numbers and then in charts. Here is the change in employment in Ohio's metro areas over the past five years when Ohio's largest metros increased their employment momentum and all other parts of Ohio either stagnated or declined:

CHANGE IN EMPLOYMENT IN PAST 5 YEARS

STATEWIDE

Ohio +227k

OHIO'S SIX LARGEST METROS

Columbus +88k

Cincinnati +85k

Cleveland +43k

Dayton +17k

Toledo +7k

Akron +5k

EVERYONE ELSE

Wheeling +3k

Canton +2k

Lima +1K

Mansfield 0

Springfield -1k

Huntington -3k

Steubenville -3k

Youngstown -9k

END