On most days, Jeff Epstein is a very busy man. Not only is he executive director of the community development corporation MidTown Cleveland Inc., he also heads up the Health-Tech Corridor.

The Health-Tech Corridor is a decade-old collaboration between MidTown Cleveland, BioEnterprise, The Cleveland Foundation and the City of Cleveland. It works to attract and grow health technology businesses to the corridor linking Downtown and University Circle.

So how busy is Epstein?

"I've been slammed," he says. But he's not complaining with how busy things have gotten, nor with how busy they could get in 2021. That's the point of the effort -- to attract investment into the corridor. And it's not just about jobs, but housing and career development.

Although COVID-19 has much of the nation and its economy feeling ill, the same cannot be said for Cleveland's Health-Tech Corridor. Here, business expansions and residential developments are picking up the pace, with numerous high-profile groundbreakings expected in 2021, Epstein notes.

The driver isn't just the ever-growing behemoth Cleveland Clinic. It's also emerging biotech firms like Athersys and Abeona fueling the growth in jobs and thus the demand for more housing -- including workforce and market-rate.

|

| Cleveland Clinic hopes to start construction on its new Nuerological Institute (at left) on Euclid Avenue. This view is looking east from East 96th Street (CCF). |

Developers of several projects are reporting that their projects in this area are advancing more quickly than any project with which they've recently been involved. They say that financing has been far less of a challenge. Some of that is due to the Health-Tech Corridor being included in an Opportunity Zone, making projects located here eligible for deferred federal tax burdens on their capital gains.

For decades, civic leaders wanted the benefits from booming University Circle-area employers to spread into the surrounding neighborhoods. Instead, only massive parking decks were built so that workers could leapfrog Cleveland's neighborhoods to/from the suburbs each day and never set foot on a city sidewalk.

That's now changing and in a big way. There's the development of Uptown, new construction and renovations in Little Italy, the widespread investment throughout Glenville and now, the construction of the high-rise apartment building One University Circle, with more high rises to come.

Adding housing, neighborhood retail, restaurants and other services within walking or biking distance of jobs is the concept behind the 15-Minute City. Not only does it enhance physical health among its residents, build a stronger sense of community and reduce environmental impact, it also boosts long-troubled urban neighborhoods -- notably those surrounding the major employers of University Circle. It is Ohio's fourth-largest employment district.

There's several previously unreported projects in the area that are just now coming out into the public eye. Several more remain undefined publicly, but are in the hands of developers who have track records of getting things done.

| Arpi Development LLC wants to build apartments on East 93rd and East 90th streets to provide housing to the grow- ing number of Health-Tech Corridor workers (GLSD). |

Yes, the Cleveland Clinic is the elephant in the room. And when the pandemic is in the rearview mirror, the Clinic's Office of Construction staff expects to start work on more than 500,000 square feet of new facilities -- a new, 400,000-square-foot neurological center and an expansion of the Cole Eye Institute measuring more than 100,000 square feet. Both projects are along and south of Euclid Avenue, between East 96th and East 105th streets.

Although the construction work has been postponed to next year due to the pandemic, Clinic officials said that "rapidly growing" patient and research needs are the motivations behind adding more facilities. That could also include future construction south of Chester Avenue between East 89th and East 90th streets, where the Clinic recently acquired more land and demolished several structures.

These actions by the 40,000-employee health system have attracted the attention of real estate developers. In response, they have acquired properties and demolished century-old walk-up apartment buildings north of Chester in the East 90s.

"Every time they (the Clinic) add more buildings, they're adding more jobs," said a member of a development team working to add housing in the East 90s but who was not authorized to speak publicly.

"There's a lack of market-rate and workforce housing in the area near the Clinic and Uptown. That's set to change," he added. "Our goal is to help Cleveland Clinic staff and other people who work in the area find affordable places to live in a safe, walkable neighborhood."

| About 160 apartments are planned by Arpi Development LLC on East 90th and 93rd streets (GLSD). |

Projects on the north side of the Clinic's Main Campus include the East 90th Street Apartments by the Inspirion Group of Cleveland and the Arpi Apartments by Arpi Development LLC, also of Cleveland. Both projects' designs received preliminary approval by City Planning Commission Dec. 18.

They followed the Finch Group's Innova development, formerly called Upper Chester. It features 247 apartments, a 161-room Residence Inn and ground-floor retailers like a Community Walgreen's Pharmacy, Penn Station East Coast Subs, Phuel Cafe, Celebrate Nutritional Supplements, Fluffy Duck Cafe, Urban Kitchen and Kinder Care Learning Centers.

The new Case Western Reserve Health Education Dental Clinic pushed development a little farther west along Chester. The new Arpi Apartments will push a fresh apearance another block farther. Geis Companies is the general contractor and architect of the apartments.

According to plans submitted to the city, Apri's first phase at 1865 E. 93rd St. would offer 42 units of mostly studio and one-bedroom apartments with a small number of two-bedroom units. All units in the four-story building will have patios or balconies. A 30-space parking lot is planned behind the building. Three vacant residences are proposed to be demolished to make way for this project.

Behind it, on East 90th, Apri Development proposes a second phase that could offer 118 apartments divided among three new buildings with parking behind them. Five residences are proposed to be demolished. Three of them, all built in 2007, are vacant and in the city's land bank.

| The Inspirion Group Ltd.'s development phasing plan along East 90th Street north of Chester Avenue (LDA). |

Across East 90th, The Inspirion Group Ltd. proposes phases one and two of its apartment development. Two additional phases could be built on both sides of East 90th, closer to Chester. But Inspirion doesn't have site control of the properties right next to Chester so their development won't have a street presence on the busy thoroughfare like Innova's.

In the first phase, Inspirion proposes a 98,846-square-foot building with 131 apartments with a mix of micro, studio, one-bedroom and two-bedroom units. Phase two would have 90 units in a 62,745-square-foot building, according to plans submitted to the city. There is no detail yet for the later phases nor any tentative start date yet for any of the phases.

A little farther west, there is a start date for the Chester75 development. Famico Foundation's Director of Real Estate Development Khrys Shefton said a Summer 2021 groundbreaking is being pursued. Famicos, a nonprofit community development corporation, is the project's developer.

Chester75, located on the northwest corner of Chester Avenue and East 75th Street, won approval last April from the city's design review committee. It is proposed to offer 11 studios, 37 one-bedroom units, three two-bedroom units, two live-work units, three townhouses and one "hoteling" unit. It will feature modern amenities such as Amazon delivery lockers, WiFi and lots of electrical outlets in each unit.

"This is attempting to drive development further into the neighborhoods," Shefton said. "We call it a workforce building but it's in support of further development in Hough that's not so adjacent to the institutions in and near University Circle."

| Schematic designs for The Inspirion Group Ltd.'s first phase of the East 90th Apartments were approved last week by the City Planning Commission (LDA). |

Apartment rents are skyrocketing in fast-growing University Circle. A 2019 report by Rent.com showed University Circle led the way in Cleveland with a 44 percent increase in rents. There, a one-bedroom apartment's rent now averages $1,853.

Rent pressures in University Circle spilled over into neighboring Hough, long a national symbol of urban decay, where average rents went up last year 7.74 percent to an average of $1,415 for a one-bedroom apartment, according to Rent.com.

"This building (Chester75) will be presented at an affordable price point with rents starting at $1,100 per month," Shefton said, or $1.75 per square foot.

A couple of blocks to the south and southeast are two intriguing and potentially significant developments that are just now starting to show up on the grid.

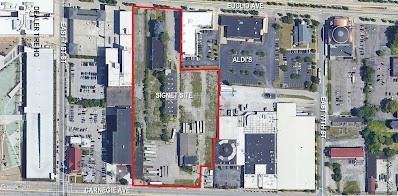

Last week, NEOtrans broke the story that several buildings including a former Euclid Avenue mansion are proposed to be demolished in the 7200 block of Euclid and Carnegie avenues by Signet Real Estate Group of Akron, city Building Department records show. This follows Signet's acquisition of nearly 6 acres of land in October for $2.4 million, according to county records.

Signet, which recently built the $35 million Axis At Ansel apartments in the Hough neighborhood, reportedly plans a primarily residential development starting at the Carnegie end, although some ground-floor commercial uses along Carnegie and Euclid may be considered. Planning for this development is in the very early stages.

Joel Maas, Signet's director of marketing and communications, acknowledged receiving an e-mail from NEOtrans seeking more information about the project but didn't otherwise respond.

Then, over on East 79th Street and north of Carnegie is another interesting, emerging project. An affiliate of LRC Realty of Akron submitted demolition requests last March for a former Sohio gas station at the northeast corner of East 79th and Carnegie as well as for a 110-year-old duplex just north of it.

On Dec. 4, a building permit application was submitted for a 66,180-square-foot building at 2065 E. 79th St. There were few other details about the proposed use of the building or who would develop it. The applicant was Burnham Nationwide Inc. of Chicago, a real estate consultant that expedites building permitting and code consulting for clients.

That's not the only Chicago connection for development activity on the east side of East 79th, north of Carnegie. A stand-alone, suburban-style Bank of America branch is proposed to be built on the site of the former Sohio station and has some high-profile Chicago-based contractors.

| The northeast corner of East 79th Street and Carnegie Avenue is a place of intrigue as an unknown developer, possibly loca- ted in Chicago, has its eyes focused here (Google). |

According to Dodge Reports, the owner's representative is Kent Liker, a project manager at Jones Lang LaSalle's Chicago office. He could not be located for comment. The civil engineer is the Calichi Design Group of Chicago. And the architect is San Francisco starchitect Gensler; their Chicago office is listed.

Bank of America typically uses Chicago-based The Architects Partnership to design its retail branches. Gensler usually only develops large, high-profile projects -- not a tiny, garden-variety bank branch.

An e-mail sent to Robert Abramovich, vice president of development at LRC Realty, was responded to by a Boardman, Ohio-based real estate advisory firm Gary G. O’Nesti & Associates, LLC. The firm typically focuses on medical, retail, office and an emphasis on shopping center development opportunities according to its Linkedin page.

"Please be advised LRC is not involved in that 66,180 SF building at 2065 East 79th you refer to in your email," O'Nesti replied. When asked who is, he did not respond further.

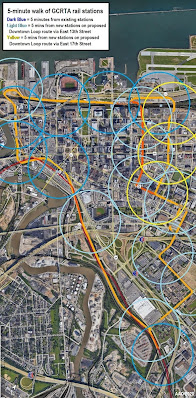

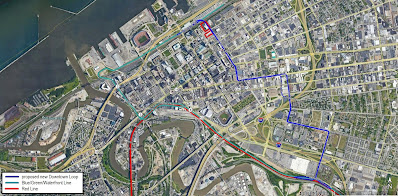

There are many more real estate development projects in active development in the Health-Tech Corridor, ranging from planning to construction. Here is a summary of developments in the corridor, from East 55th Street eastward to just uphill from University Circle:

|

| Twenty development sites are shown in the above map and described below with links to more information about each. |

(1) 5200-5805 Eucld Ave. -- Unidentified development; Berusch Development Partners; no estimate of investment value; Thanks to assembly of 2.6 acres of land by MidTown Cleveland and the Cleveland-Cuyahoga County Port Authority, this reportedly will involve a mixed-use development intended to restore the urban vibrancy of this once-densely developed intersection. This may be a much larger project when included with the next site; no estimated construction start date.

(2) 5508-5510 Euclid -- Unidentified development; No identified developer; no estimate of investment value; Eight contiguous properties totaling 2.38 acres changed hands twice in the past year. First they were sold by the Greater Cleveland Regional Transit Authority in April to Civic Development Partners, an affiliate of the Cleveland Foundation, for a future mixed-use development. They were transferred again Dec. 16, this time to the Cleveland-Cuyahoga County Port Authority to help facilitate future development; no estimated construction start date.

(3) 5601 Carnegie Ave. -- Warner & Swasey redevelopment; Pennrose LLC; $53 million; Redevelopment of this 19th-century factory into 140 senior and workforce housing units, plus 30,000 square feet of office space for job readiness, workforce development and employment training organizations. A small amenity retail component will also be included; no estimated construction start date.

(4) 1778 E. 63rd St. -- MAGNET headquarters; Manufacturing Advocacy and Growth Network; $10 million; Redevelopment of the closed Margaret Ireland Elementary School into MAGNET's new headquarters including new offices, classrooms and labs; project may be completed in early 2022.

| Looking north up East 66th Street from Euclid Avenue a few years from now, one may see the proposed Center for Innovation at left and new Cleveland Foundation headquarters at right (S9). |

(5A) 6545 Euclid -- Center for Innovation; MidTown Cleveland et al; no estimate of investment value; MidTown, Cleveland Foundation and JumpStart Inc. hired Wexford Science & Technology, LLC of Baltimore to be their master developer of the 100,000-square-foot Center for Innovation at the northwest corner of Euclid and East 66th Street as well as the new Cleveland Foundation headquarters across East 66th; no estimated construction start date.

(5B) 6601 Euclid -- Cleveland Foundation headquarters; Cleveland Foundation; $22 million; The new 54,000-square-foot building will allow the foundation to relocate its headquarters from the Hanna Building downtown and help support innovation and quality-of-life programs in the city's neighborhoods; construction is due to start in early 2021.

(6) 2024 E. 70th St. -- The 70; The Sobor Group; about $15 million; A 64-unit, five-story apartment building would be located midway between Euclid and Carnegie avenues amid the new Dealer Tire headquarters and the Midtown Tech Park. Sabor develops real estate in Hungary and the USA (Cleveland and Detroit) including the Euclid Lofts, 3800 Euclid Ave.; no estimated construction start date.

(7) 7128-7144 Simpson Ct. -- One MidTown luxury townhomes; Vazza Real Estate Group; about $1.5 million; Phase two was announced in October after phase one sold out. Townhomes in phase one sold for from $320,00 to $510,000 each. Another 13 townhomes are planned in later phases at Euclid and East 73rd Street; no estimated construction start date.

| Construction could begin by Summer 2021 on Chester75 at the northwest corner of East 75th Street and Chester Avenue in the Hough neighborhood (City Architecture). |

(8) 1914 E. 75th. St. -- Chester75; Famicos Foundation; nearly $15 million; Designs were approved in 2020 for a 57-unit residential building measuring 56,700 square feet on the current site of the Kingdom Hall on the northwest corner of Chester Avenue and East 75th Street; construction could start in Summer 2021.

(9) 7200 block of Euclid and Carnegie -- Unidentified development; Signet Real Estate Group; no estimate of investment value; Signet acquired nearly 6 acres of land in October for $2.4 million and has submitted applications to demolish several structures on its property for a mostly residential mixed-use development; no estimated construction start date.

(10) 7911 Carnegie/2065 E. 79th St. -- Unidentified development; no identified developer; no estimate of investment value; A Bank of America branch is proposed to be built at the northeast corner of Carnegie and East 79th with a new 66,180-square-foot building of unknown purpose is proposed to be constructed just north of it; no estimated construction start date.

(11) 1832-1886 E. 90th St. -- East 90th Apartments; The Inspirion Group Ltd.; up to $40 million for the first two phases; In its first phase, Inspirion proposes a 98,846-square-foot building with 131 apartments and, in the second phase, 90 units in a 62,745-square-foot building are proposed; no estimated construction start date.

(12) 1865 E. 93rd St. -- Arpi Apartments; Arpi Development LLC; no estimate of investment value; Arpi Development and Geis Companies plans to construct a 42-unit, 39,584-square-foot apartment building as the first phase of a two-phase development. Later phases could see another 118 apartments in three buildings added on East 90th; construction could start by mid-2021.

(13) 9606 Euclid -- Neurological Institute -- Cleveland Clinic Foundation; no estimate of investment value; Proposed is a new, larger Neurological Institute measuring 400,000 square feet to replace older facilities immediately west on the Cleveland Clinic's Main Campus; start date is estimated to occur sometime in 2022.

(14) 9900 Cedar Ave. -- BioRepository; Cleveland Clinic Foundation; $11.3 million; In partnership with Brooks Automation and Geis Companies, Cleveland Clinic Foundation is building a new, 21,000-square-foot facility to bank and distribute human biospecimens to the scientific community for research; project to be completed in 2021.

(15) 10300 Cedar -- Mixed-use development; Fairmount Properties; no estimate of investment value; Proposed in the first phase are up to 300 micro-unit apartments, several dozen townhouses and several hundred parking spaces next to or above a 40,000-square-foot Meijer grocery store; start date is estimated to be sometime in 2021.

(16) 2258 E. 105th St. -- Innovation Square; Fairfax Renaissance; $12.75 million; Proposed in the first phase are 85 apartments, nearly half of which will be affordable. Among all three phases, Innovation Square will have about 223 apartments; a spring groundbreaking date is anticipated.

(17) 2137 E. 107 St. -- Unidentified development; unidentified developer; no estimate of investment value; Multi-story apartment building with possible ground-floor commercial uses however programming is going through substantial revision. The project could expand onto land south along East 107th and/or east along Carnegie as parcels are availble for sale; no estimated construction start date.

(18) 2030 E. 105th St. -- Cole Eye Institute expansion; Cleveland Clinic Foundation; no estimate of investment value; To accommodate significantly rising patient visits and procedures, the existing 130,000-square-foot facility will be expanded by more than 100,000 square feet and the 2000-built structure will be renovated; start date is estimated to occur sometime in 2022.

(19) 10553 Euclid & 10600 Chester -- Circle Square; Midwest Development Partners et al; $300 million among all phases; In their first phase, Midwest Development Partners, White Oak Realty Partners and Cleveland Public Library are developing the 11-story Library Lofts atop a new MLK Branch Library as well as a 24-story apartment tower over ground-floor commercial spaces; groundbreaking date is anticipated in the second quarter of 2021.

| The largest real estate development in the Health-Tech Cor- ridor is City Square which would essentially build a new downtown area for University Circle (Bialosky). |

(20) 1855 Ansel Rd. -- Maltz Performing Arts Center expansion; Case Western Reserve University; $74 million; The expansion at Temple-Tifereth Israel will feature a 250-seat theater, a 100-seat studio theater, costume and scene shops, office, and a lobby with entrances off East 105th and Ansel.

Additional development on the hill and up the hill from University Circle are happening and are directly related to the Health-Tech Corridor's growth but are not included in the above list. The largest is the $80 million The Ascent at Top of The Hill in Cleveland Heights. Integrity's 58-unit dormitory project across Euclid Heights Boulevard from The Ascent.

Case Western Reserve University's $72 million South Village expansion was put on hold during the pandemic. Premier Development Partners' residential development on the site of the Cleveland Clinic's Fairhill Facility, 11203 Fairhill Rd., is underway. Construction is also underway on the new 44-unit Baricelli Inn Apartments in Little Italy with proposed residences on the old Woodhill Supply site between Coltman Road and East 123rd Street in early planning.

END