|

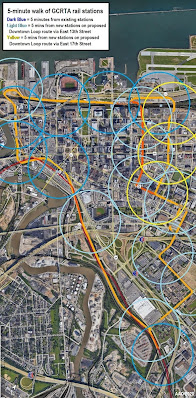

Multiple megaprojects in Greater Cleveland may receive

Transformational Mixed Development tax credits in the

next two years if the Ohio House acts on pending legi-

slation as early as next week (AerialAgents).

CLICK IMAGES TO ENLARGE THEM |

UPDATED NOV. 28, 2020

After this Thanksgiving holiday week, state lawmakers say there's a pretty good chance that the Ohio General Assembly will finally pass the long-sought Transformational Mixed Use Development (TMUD) tax credit. And there's potentially dozens of so-called megaprojects that the TMUD credit could activate or take already active projects and push them across the finish line.

Those dozens of megaprojects are just in the Greater Cleveland area. There are many promising transformational projects in Ohio's six largest metro areas that accounted for all of Ohio's job growth in the past five years, as well as in smaller cities and rural areas that have been economically left behind.

If Substitute Senate Bill 39, the TMUD tax credit, passes the Ohio House of Representatives as a clean, unamended bill in one of up to seven House floor sessions between Dec. 1-17, it will become law. The only way it wouldn't is if Gov. Mike DeWine vetoes it. No one expects him to do that. Rather, they expect him to sign it. Even if he takes no action within 10 days of receiving Sub. SB 39, the bill becomes law without his signature.

Barring any surprises, chances of passage by the House are good said Rep. Mike Skindell (D-13) of Lakewood. He serves on the Ohio House's Economic and Workforce Development Committee that held eight hearings on the bill. The committee passed Sub. SB 39 on Nov. 18 for the House vote.

The House substantially amended it from what the Ohio Senate had passed 32-1 last year, but in the same two-year legislative session that ends Dec. 31. The Ohio Senate notified the Ohio House that it supports the House version, making a conference committee unecessary.

|

Ohio State House, Columbus, OH (NEOtrans file).

|

"It wouldn't be up for a floor vote if the House leaders didn't think they had the votes (to pass it)," Skindell said.

If it becomes law, there will be up to $100 million in tax credits available to insurance companies that invest in TMUDs in each of the next two years. By issuing a TMUD tax credit, the Ohio Tax Credit Authority would refund to insurance companies up to 10 percent of their investment in a TMUD. The credit would be capped at $40 million per project. Most projects would receive far less.

Up to $80 million will be available to urban projects statewide having at least a 15-story building or 350,000 square feet within 10 miles from a major city that has a population larger than 100,000 people. The development must cause a positive economic impact as measured by the net change in taxes produced by the development.

Another $20 million will be available to projects with buildings only four stories in height and a total size of 75,000 square feet in smaller towns and rural areas that are 10 miles or more from a major city.

Under those criteria, a large number of active and emerging projects could qualify statewide, not merely the project that hatched the TMUD concept in the first place --

nuCLEus. Between now and the end of 2022, Stark Enterprises' proposed 25-story office tower atop a pedestal of parking and retail would have to compete for $160 million in tax credits with potentially dozens of projects just in the Greater Cleveland area alone.

Listed alphabetically, local TMUDs could include:

|

Baseball Town site, east of Progressive Field (Google).

|

BASEBALL TOWN -- Major League Baseball wants to see the areas around ballparks developed with more mixed uses, not just restaurants and bars. Developers who wish to remain unidentified are proposing apartment buildings across East 9th Street from Progressive Field.

One of those projects, called the Sumner Avenue Apartments, appeared on a

public record earlier this year. This and other buildings would transform an area of parking lots at the East 9th entry into downtown into a dense, vibrant urban neighborhood.

|

| Site plan for Belle Oaks at Richmond Road (DealPoint Merrill). |

BELLE OAKS AT RICHMOND ROAD -- Redevelopment of Richmond Town Square (formerly Richmond Mall) into a

$200 million mixed-use development will feature nearly 800 market-rate apartment, retail/commercial spaces and recreation areas.

The city of Richmond Heights recently approved a New Community Authority to oversee finances involving the proposed project. Additional public funding could come into play for a project that could measure 1.6 million square feet at full buildout.

|

Bridgeworks conceptual plan (MASS/RDL).

|

BRIDGEWORKS -- Developers of this multi-structure project at the west end of the Detroit-Superior Bridge may not need a TMUD credit to make their project happen. But they could seek tax credits to enhance their project and make it potentially transformative by creating a user-friendly access point to the streetcar subway deck of the bridge.

That access point is identified in

Bridgeworks planning documents as a connection between Ohio City's Hingetown neighborhood and downtown, offering a more climate-protected route for pedestrians and cyclists, as well as a public realm for community events and programming.

|

Cumberland Development's lakefront plan (Dimit).

|

BROWNS LAKEFRONT -- Like the Baseball Town noted above, National Football League teams are also seeking to develop the areas around their stadiums with mixed uses. The Cleveland Browns and their principal owner, the Haslam Family, want to develop

Cleveland's lakefront and connect it better with downtown. Mayor Frank Jackson's administration favored the Haslam plan over a prior plan by Cumberland Development LLC.

While possibly transformative, Haslam's plans are secret. There are rumors the plans could involve building a new football stadium off the lake before the Browns' lease with the city ends in 2029, then raze First Energy Stadium and develop the massive amount of lakefront land that would be made available.

|

The Centennial (The Millennia Companies).

|

THE CENTENNIAL -- As proposed by The Millennia Companies, a $450 million redevelopment of the 1.3-million-square-foot, former Union Trust Bank at 925 Euclid Ave. into The Centennial would be the largest building conversion attempted in downtown Cleveland.

Millennia CEO Frank Sinito testified in 2019 that Centennial would be difficult to develop without with the TMUD tax credit. With it, he could convert the vacant, 21-story building into 860 affordable apartments, 95,000 square feet of offices, 20,000 square feet of retail, and convert the world's largest bank lobby into dining, event and museum spaces.

|

Circle Square, looking north on Stokes Boulevard (Bialosky).

|

CIRCLE SQUARE -- Although the first phase of the $300 million Circle Square development appears to be on track, there's much more planned and could benefit from the TMUD tax credit. The first phase has a 24-story apartment tower by Chicago-based White Oak Realty Partners, an 11-story apartment building by Midwest Development Partners, a large public parking garage and a new MLK Branch Library between Euclid and Chester avenues, along Stokes Boulevard.

Future phases would add another large apartment tower, an office building, hotel and up to 100,000 square feet of retail. Cleveland has high construction costs and low office rents despite the tight Class A office market, and few subsidies for office development. A TMUD tax credit could fill that void.

|

Columbus Road Peninsula (Google).

|

COLUMBUS ROAD PENINSULA -- Unnamed developers want to invest in the Columbus Road Peninsula, including mixed-use development where zoning allows new buildings up to 175 feet tall. Existing grain elevators on the peninsula are about 155 feet tall, equal to a 15-story building. Whether new buildings or a converted old structure are repurposed, they could meet the TMUD's physical requirements.

Also, much of the peninsula along the Cuyahoga River's Flats was recently designated as an historic district which could leverage historic credits for the renovation of its building stock, some of which dates to the 1850s. Combined with a TMUD tax credit, the entire peninsula could be reinvigorated with a mix of uses.

|

Dream Hotel, Cleveland (Bialosky).

|

DREAM HOTEL -- Pursuing the development of any hotel project during a global pandemic is a challenge. Trying to build a 19-story hotel for guests of live performances at the neighboring Masonic Temple, 3614 Euclid Ave, is even more problematic.

That's why the project has been put on hold for at least one year. A TMUD tax credit could give the hotel, featuring restaurants and event spaces, a fiscal stimulus and help restart Cleveland's hospitality industry. The project could also provide a significant boost the surrounding area of Midtown.

|

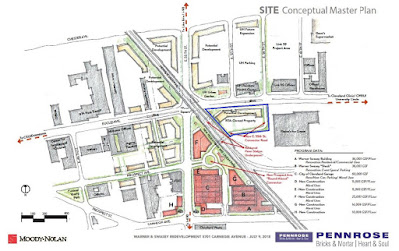

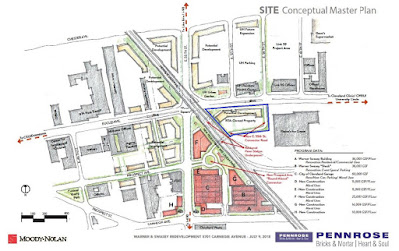

East 55th-Euclid conceptual master plan (Moody Nolan).

|

EAST 55TH-EUCLID -- Numerous projects in the heart of Midtown at East 55th Street and Euclid Avenue are coming to the fore and even could be candidates for a TMUD credit. But those projects are being sought by more than one developer, so individually each is not a megaproject but collectively they might be.

They include later phases of the Warner & Swasey redevelopment, an unidentified mixed-use development on Cleveland-Cuyahoga County Port Authority-owned land on the west side of East 55th, potential developments on land owned by the Cleveland Foundation on both sides of Euclid east of East 55th and additional proposals that are still in the early stages.

|

Geotech drilling rig, June 2019, 2177 E. 9th St. (Clifton Haworth).

|

EAST 9TH-BOLIVAR -- Five years ago, Downtown Investment Group LLC, a Geis Companies affiliate, bought the former New York Spaghetti House and razed it for future development. The city in 2015 gave Geis permission to use the property as a parking lot for up to five years.

When the city gave its blessing for the interim parking lot, a Geis official told the city that it already has a motivation to develop the land -- it paid $1.5 million for the 0.314-acre property. To recoup that investment, a significant vertical development is justified. A residential tower or a mixed-use tower has been rumored after a geotech drilling rig was spotted here gathering core samples in June 2019. A TMUD tax credit could make the numbers work for whatever Geis decides to build.

|

Fairmount mixed-use development site (Google).

|

FAIRMOUNT-CLEVELAND CLINIC -- Full details are unknown of what is ultimately planned by Fairmount Properties LLC southeast of the Cleveland Clinic's main campus. But, it may well be a transformative project for that area. Fairmount has site control of 3 acres of land bounded by East 105th Street, East 101st Street, Cedar Avenue and Wain Court.

The first phase alone is impressive in its scale. It includes 250-300 micro-unit apartments, several dozen townhouses, and several hundred parking spaces next to or above a 40,000-square-foot grocery store that reportedly will be a Meijer. The next phase could be of a similar scale, bringing the total development to a size comensurate with what Sub. SB 39 might call a TMUD.

|

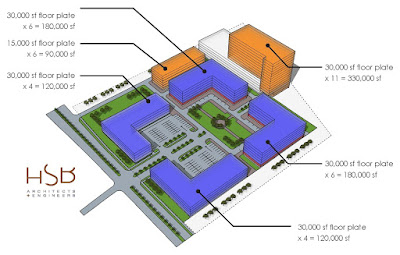

| Flats East Bank next phases (HSB). |

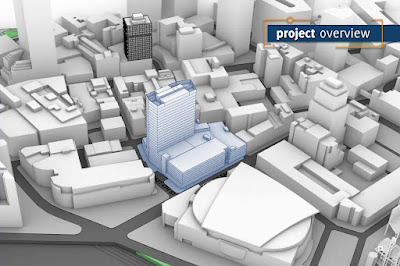

FLATS EAST BANK -- Chicago-based Akara Partners and the Wolstein Group plan to proceed with Phase 3b of Flats East Bank in early 2021, featuring an 11-story mixed-use building. While that building may not have the square footage to qualify as a TMUD, the next five buildings might.

Wolstein plans five more towers along and north of Front Street, featuring up to 2,000 housing units, plus coworking spaces, neighborhood retail, restaurants and parking. In total, those would probably be large enough to be considered a TMUD.

|

Hough Bakery plant (Google).

|

HOUGH BAKERY PLANT -- Through a partnership, Knez Homes and Forest City Shuffleboard owner Jim Miketo acquired the 5-acre Hough Bakery plant on Lakeview Road at the Cleveland-East Cleveland line.

In addition to residential, it isn't known if any other land uses will be present such as retail or recreation. Nor is it known how many square feet of structures will be built to augment the 81,000 square feet of buildings already on the site. But given the size of the property involved, it's certainly possible that whatever is built here could achieve TMUD status.

|

CASTO Lakewood plan (Dimit).

|

LAKEWOOD HOSPITAL REDEVELOPMENT -- One of the suburban megaprojects is the redevelopment of the former site of the Lakewood Hospital, owned by the city. After Carnegie Management & Development withdrew from the project, Columbus-based CASTO reportedly is favored by the city to take over the project.

For the 5.6-acre site, CASTO in 2017 proposed a $62 million project with 280 residential units (apartments and townhomes), 23,673 square feet of ground-floor retail, restaurants and community spaces, 50,265 square feet of offices plus 569 parking spaces. It isn't yet known if they would propose the same mix of uses today, however.

|

The red outline in the foreground is of the Lutheran Hospital

parking lot property. The yellow line is a property owned by a

partnership of the Weston Group and My Place Homes (Google).

|

LUTHERAN HOSPITAL PARKING LOT -- In Ohio City, a 5-acre parking lot on West 25th Street owned by Cleveland Clinic's Lutheran Hospital and used by its employees and visitors is reportedly targeted by a partnership of Weston Group and the Kertesz family. Developing it would remove a dead zone on West 25th between Hingetown to the north and the Market District to the south.

In 2017,the partnership acquired a half-acre of land at 1550 W. 25th that's surrounded by the hospital's parking lot. Developing the lot will be expensive, primarily because its 530 parking spaces (and possibly another 220 spaces south of the hospital) have to be moved somewhere, such as into a parking deck costing $20+ million that Cleveland Clinic doesn't need and from which no else would receive any private, long-term benefit.

|

| Unofficial view of Magellan-Weston project (Ian McDaniel). |

MAGELLAN-WESTON PROJECT -- Another Weston property is the site of a potential megaproject, this time west of West 3rd St. and north of St. Clair Avenue in downtown's Warehouse District. Three sources say the partner in this development is Chicago-based Magellan Development Group LLC.

Together, the Magellan-Weston partnership plans a roughly 30-story residential-hotel tower and a separate office building over a pedestal of parking and retail, according to sources. The project sounds eerily similar to nuCLEus. If so, it too might also need a TMUD tax credit to make the project financially feasible.

|

Construction continues on the Market Square apartment

building called Intro at left but the office building at right

remains unfunded and in limbo (HBRA).

|

MARKET SQUARE OFFICE BUILDING -- Another Chicago developer, Harbor Bay Realty Advisors, has started work on a 350,000-square-foot residential building with ground-floor commercial spaces and subterranean parking called Intro.

A second phase of the development would add a 150,000 to 200,000-square-foot office building. Harbor Bay was ready to build it last year but a proposed tax exemption by the state was blocked by the City of Cleveland. While the city has since granted tax abatement to the residential portion now underway, it would not provide tax abatement for the office building. A TMUD tax credit could provide the public assistance.

|

A massing of The Mews on East 90th Street that was

submitted to City Planning Commission (Hakki). |

THE MEWS ON EAST 90TH STREET -- Inspirion Group, Structures Unlimited and possibly others are pursuing a significant development along and near East 90th Street, between Chester Avenue and Hough Avenue. Previously, Inspirion proposed Core 90, a mixed-use development of offices, labs and apartments. Then it shed the offices/labs for a residential-only project called East 90th Street Apartments.

The Mews On East 90th Street vision remains heavy on residential with a first-phase structure that is taller and more massive than those that still stand in the area. That brought some pushback from the neighborhood design review committee which tabled consideration of Inspirion's preliminary design last summer, saying the project dwarfed its surroundings.

|

Nautica Waterfront development (AoDK).

|

NAUTICA WATERFRONT -- A massive, multi-structure, mixed-use development was proposed on 22 acres of Flats West Bank land -- 5.6 acres of which now is for sale. The property has attracted interest from developers, including CASTO who has since walked away from buying land here.

But developing the Nautica Waterfront and a nearby property that's for sale at 1250 Riverbed St. may first require construction of a large parking deck costing more than $20 million. Parking decks usually don't make money so finding some public subsidy like the TMUD tax credit for the garage will likely be needed.

|

One nuCLEus Place (Bialosky).

|

NUCLEUS -- This is the project that got the ball rolling on creating the TMUD tax credit. Stark Enterprises tried other public financing ideas that failed to gain traction among the City of Cleveland as well as the Cleveland Metropolitan School District.

Stark's persistence is noteworthy. NuCLEus has been planned since 2014 and the TMUD tax credit proposal was drawn up nearly four years ago. It has worked its way through Ohio's General Assembly twice and could finally be weeks away from becoming law. But as we see here, nuCLEus could face some tough competition in winning a tax credit.

|

Ohio City Transit Oriented Development site (Google).

|

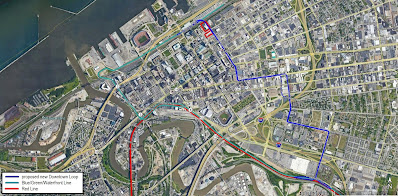

OHIO CITY TOD -- The Greater Cleveland Regional Transit Authority (GCRTA) will partner with MRN Ltd. to develop land next to and possibly above its Ohio City Red Line station as a Transit Oriented Development (TOD).

GCRTA went with second-choice MRN after its first choice, Carnegie Management & Development, withdrew from the project.

While it is too early to say what form the development could take, if it is truly a TOD, more density and mixed use need to be added to the medium-density station area to produce meaningful ridership and revenue to RTA. For its part, RTA could use the revenue to update the aging station. It was GCRTA's first rail stop to be replaced with an ADA-compliant facility 30 years ago.

|

Richman Brothers building (LoopNet).

|

RICHMAN BROTHERS -- One of the largest vacant buildings, if not the largest on the east side of Cleveland is the old Richman Brothers warehouse and factory, 1600 E. 55th St. Several efforts to develop the massive structure have failed due to its scale, high cost and low rents in the surrounding neighborhood.

But redeveloping it with the right mix of uses would almost certainly transform the neighborhood. The

building is for sale and could attract serious developers if there were more public subsidies available to projects of this scale.

|

Rockefeller Building (KJP).

|

ROCKEFELLER BUILDING -- Plans are moving forward to

redevelop with mixed uses the 17-story, 115-year-old building at 614 W. Superior Ave. built by Cleveland native and Standard Oil Co. founder John D. Rockefeller.

Realty Dynamics Equity Partners and Wolfe Investments will redevelop the 261,264-square-foot building with 436 apartments including 273 micro units, plus ground-floor retail/restaurants. The 43,617-square-foot, 95-year-old garage behind is being split off as a separate, future project. Development of 1.1 acres of adjacent surface parking lots is also possible for the future.

|

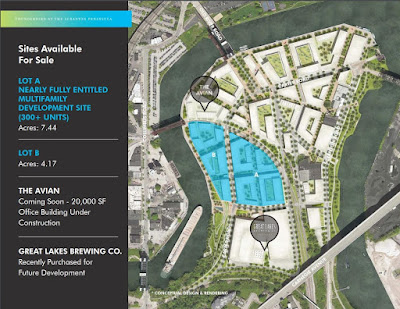

Scranton Peninsula land for sale October 2020 (CBRE).

|

SCRANTON PENINSULA -- Although development of Scranton Peninsula, just across the Cuyahoga River from the Tower City complex, has stalled, it could be reinvigorated with a TMUD tax credit. Sherwin-Williams tried to build its new research facility here but reportedly couldn't get property owner Scranton-Averell Inc. to be responsive to its overtures.

Great Lakes Brewing Co. remains interested in developing on the peninsula as part of the Thunderbird master development plan but NRP Group has walked away from building 330 residential units here. Several parcels remain for sale. They could gain more interest if the TMUD tax credit was available.

|

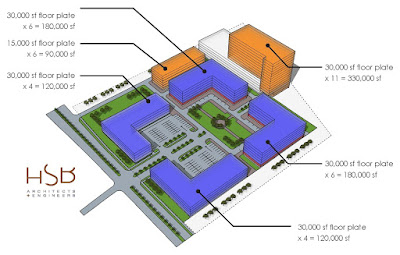

Silverpoint conceptual plan (HSB).

|

SILVERPOINT -- Cannata Companies plans a 1-million-square-foot, mixed-use development called Silverpoint on 14.5 acres in Warrensville Heights, next to Interstate 271. Cannata acquired the land from Little Sisters of the Poor for $2.2 million and secured a $1 million county loan to remediate the site's environmental conditions.

Proposed are structures rising from four to 11 stories high for apartments, hotel, offices and ground-floor retail/restaurants. The project is estimated to have a construction price tag of $87 million, according to Cannata.

|

Tower City Riverview conceptual plan (Vocon).

|

TOWER CITY RIVERVIEW/CITYBLOCK -- Bedrock Real Estate Services' planned remake of The Avenue shopping mall at Tower City Center into a 350,000-square-foot entrepreneurship hub could add residential and office development on the Riverview phase overlooking the Cuyahoga River.

Bedrock will reportedly pursue the new Justice Center courthouse complex while the jail will likely move out of downtown. The courthouse will probably stay downtown and measure anywhere from 877,000 to 1.1 million square feet of usable space.

|

Van Aken District in Shaker Heights showing future/second-

phase elements -- residential and office buildings (RMS).

|

VAN AKEN DISTRICT PHASE 2 -- RMS Corp. completed its first phase of the Van Aken District in early 2019, by quickly leasing 90 percent of its office, residential and retail components. Now, RMS is looking to develop the second phase which could continue to remake the area from a suburban strip shopping plaza in Shaker Heights' downtown. That could mean going vertical.

Two sources said RMS is considering building a 15-story residential building north of Farnsleigh Road plus a large office building with ground-floor retail/restaurants at the northwest corner of Chagrin Boulevard and Warrensville Center Road. The 15-story residential building would allow the development to meet TMUD status.

|

The Viaduct city-approved design (Dimit).

|

THE VIADUCT -- A 27-story apartment tower with ground-floor retail proposed to rise at 2208 Superior Viaduct was approved by City Planning Commission last summer. But there are rumors that United Community Developers is having difficulty securing financing for the skyscraper. A TMUD tax credit could give the project more credibility.

The developer, having no experience in developing major projects, is attempting to secure a loan from the Cleveland-Cuyahoga County Port Authority. It has an experienced general contractor in Geis Companies, but Geis has never built a skyscraper from the ground up. So it has joined with Osborne Group to assist it.

|

Westinghouse Corp. plant (LoopNet).

|

WESTINGHOUSE PLANT -- Redevelopment of the 303,000-square-foot vacant manufacturing complex at 1200 W. 58th St. has proven elusive to more than one prospective developer. Parts of the complex date to the 1800s and require significant environmental clean-up.

While conversion of the eight-story structure into apartments is a no-brainer, developers have been stymied with what to do with several low-level structures that may need to be at least partially demolished. That makes site preparation expensive before any development occurs. The scale of any protential development here would have to be significant to offset the site-prep costs.

|

Wolstein Center, Cleveland State University (DCA).

|

WOLSTEIN CENTER REDEVELOPMENT -- Two sources say that an unidentified developer seeks to build a large, mixed-use development on a 9.3-acre parcel now occupied by the three-decade-old Wolstein Center arena. The large arena is owned by Cleveland State University but needs a smaller facility. The developer's interest is reportedly why CSU is purusing a

campus-wide master plan.

The master plan will "assess athletic and resident facilities and make recommendations for growth including a focus on the Wolstein Center Arena." Given the size of the arena property, it is possible that its redevelopment could be a candidate for a TMUD tax credit.

_____________________

Not all of the above projects will get built but some will. More are likely if the TMUD tax credit is available to them. If Greater Cleveland gets its share of TMUD tax credits merely based on population, it should get about 20 percent or $32 million. If all of the above projects apply for and receive tax credits, that would be an average of $1.28 million per project.

Some projects might need as little as that to push them across the finish line. But other projects including the one that started it all (nuCLEus) will likely need much more than that. There will be some projects that get left out of the competition entirely.

But suffice it to say, if the TMUD credit becomes law, there's probably going to be some transformative real estate projects in Greater Cleveland in the coming years.

EN