|

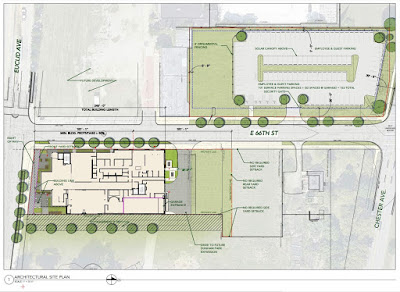

These are the original visions for nuCLEus (left) in 2014 and Circle

Square in 2015, then-called University Circle City Centre (UC3).

Both developments evolved over time yet neither project has

turned a shovel of dirt so far. Despite their similarities, there

are differences that have put more scrutiny on nuCLEus

and given more love to Circle Square (Stark/Midwest).

CLICK IMAGES TO ENLARGE THEM |

Two births were noted in 2014. Ideas for a pair of major urban core real estate developments in Cleveland -- nuCLEus and Circle Square -- were set into motion, leading to much excitement and debate by everyone from urbanistas to media to fellow developers to elected officials.

Since those births six years ago, neither project has turned a shovel of dirt for new construction. Yet nuCLEus gets publicly criticized and doubted while Circle Square doesn't. Is that fair? Let's take a look at that....

First, let's go back in time six years. Most Clevelanders first heard about nuCLEus in the summer of 2014 when Cleveland-dot-com published an article about a partnership of Stark Enterprises and J-Dek Investments Ltd. buying two separate swaths of downtown parking lots from a Los Angeles firm.

One of those swaths was the proposed site for nuCLEus -- a 3-acre plot bounded by Prospect Avenue, East 4th Street and Huron Road just north of today's Rocket Mortgage Fieldhouse. The other swath was next to West 9th Street in the Warehouse District. The article was followed by another with graphics showing a massive, $500 million mixed-use development marked by a 54-story Jenga-styled residential tower and a hotel bridging over to a second, shorter tower for offices.

At about the same time of Stark's announcement, a new development team was already in the process of buying pieces of land in University Circle under different names, apparently to disguise the scale of an emerging development.

|

Stark Enterprises' original site plan for nuCLEus that featured

the 54-story residential tower and a hotel bridge building

extending over a laneway to an office building (Stark).

|

I noticed those purchases in August 2015 during my regular scouring of public records and posted the potential implications of them on UrbanOhio. My posting about that discovery became the first of what would become a forum discussion thread about Circle Square.

Public records revealed there was something in the works that would measure about 7 acres -- far larger than the upcoming sale of two neighboring public parcels -- a police station and Cleveland Public Library branch. A month later, in September 2015, the massive development concept was announced as University Circle City Centre (UC3) when Midwest Development Partners won the bid to acquire the police station and library sites.

The initial conceptual vision showed roughly eight new buildings constructed around parking garages along with a handful of townhouses. Most of the buildings were proposed to be shorter than the neighboring 1920s-era Fenway Manor and Judson Manor apartment buildings that measure 13 and 11 stories, respectively. The exception was one proposed tower approaching 20 stories.

And then began the separate paths on which the two developments traveled for the next five years and how people reacted to those developments.

CONCEPTS/VISIONS: Both projects have seen their plans evolve over time as most projects do. But Stark Enterprises' plans have evolved significantly or, more accurately, de-evolved. It started as a stunning Jenga-style tower that would have been Cleveland's second-tallest building featuring 500 residences, 200,000 square feet of offices and a mid-tower six-story bridge with a hotel in it. The complex would be constructed atop a massive podium of parking for 1,600 cars and 140,000 square feet of retail.

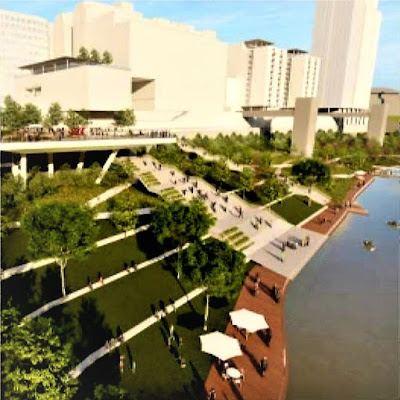

|

An early massing for Circle Square showing existing and pro-

posed buildings alike, looking south on East 107th Street with

the Epworth-Euclid United Methodist Church in the left-fore-

ground and Judson Manor on the right forground (Midwest). |

Developer Robert Stark said nuCLEus would have "the kind of architecture that lets the world know that Cleveland is back, and that Cleveland is in competition with Chicago and New York." With that lofty goal, Stark set the bar high yet couldn't jump over it.

In University Circle, Midwest's Steve Rubin, former chief operating officer of Stark Enterprises, originally proposed a development even larger than nuCLEus if structured parking wasn't included. Envisioned was 717 apartments, about 150,000 square feet of retail and community space (including a new MLK library) and 17,500 square feet of office.

That doesn't include the $40 million renovation of the 144-unit Fenway Manor apartments. Refurbishing of the senior housing technically represented the first phase of Circle Square. That was completed two years ago which implies that Circle Square is already underway. But the new construction hasn't begun.

Although set at a bar numerically higher than the total usable square feet of nuCLEus, Midwest designed the project so it could be achieved one or two buildings at a time. For Stark, it had to first build NuCLEus' massive pedestal of structured parking and downtown retail -- two uses that have proven to be tough to make money at -- before it could construct anything on top of them.

FINANCING: Both nuCLEus and Circle Square depend on public financing, as do most projects in Cleveland which has the nation's 15th-highest construction costs but the nation's third-cheapest rents among major metros. And since Greater Cleveland isn't growing, any new development that doesn't draw from outside the metro area is going to leave a vacancy somewhere else within the region.

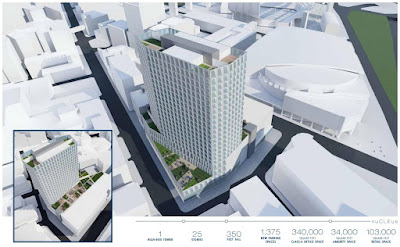

|

The second announced plan for nuCLEus featured two 24-story

towers -- one for offices (at left) and the other for residential.

Gone was the hotel bridge and the 54-story tower (Stark). |

Two of Stark's principal office tenants -- the law firm Benesch, Friedlander, Coplan & Aronoff LLP and Stark's own headquarters -- would relocate from elsewhere downtown, raising its vacancy numbers. Media has scrutinized Stark for tapping subsidies that poach tenants. Stark has proposed creative new public financing methods so it could build nuCLEus.They include a Tranformational Mixed Used Development (TMUD) tax credit at the state level, a tax-increment financing mechanism involving the Cleveland schools and a forgivable loan from the city. None of the public financing methods have yet been enacted.

Midwest also has proposed a unique public financing arrangement for Circle Square as well as attracting a tenant from a nearby property. In this case, they are one in the same. The Cleveland Public Library sought to relocate its MLK branch and Midwest offered to incorporate it on the ground floor of one of Circle Square's apartment buildings, now called Library Lofts. The library's financing will also contribute some public dollars and pedestrian activity to Circle Square just as the developer's exterior structure for Library Lofts will benefit the new library.

The scale of both projects required non-conventional subsidies. Circle Square has found its subsidy to get the project going toward a publicly identified groundbreaking, tentatively scheduled for March 2021. Stark never found its public subsidy magic bullet. But that's not what's holding back the project anymore. Instead, the project is reportedly in need of more leases before Stark can announce a groundbreaking date.

RECORDS OF ACHIEVEMENT: When it comes to the historical record of achievements by both developers, there isn't much of a comparison for a couple of reasons. First, Midwest doesn't have much of a history. The company itself wasn't incorporated until February 2015 (although it was preceded by Intesa Holdings LLC in 2012). Secondly and ironically, its principal partner Rubin was the chief operating officer at Stark for 12 years until Fall 2014 before he formed Midwest.

So Midwest's history is in many ways Stark's history. Rubin was able to hit the reset button on his own corporate development history by creating a new real estate entity. He could enjoy all of the benefits of a clean slate while touting his accomplishments at Stark.

|

When Centric was called Intesa, it proposed an ambitious develop-

ment vision between Little Italy and the Uptown section of Uni-

versity Circle. It was scaled back to a single 7-story building of

apartments over retail, fronting a parking garage (Bialosky).

|

Rubin joined Stark while the firm was partnering with the Carney Group on its biggest development ever -- the Crocker Park lifestyle center in Westlake. The first phase of the development opened in 2004. It was built south of the Promenade, originally planned by Stark in the late 1980s as an enclosed mall but built as an outdoor strip mall. Stark gained the reputation of a strip-mall developer. Crocker Park helped Bob Stark shed that reputation.

After Crocker Park opened, Stark publicly set its eyes on downtown Cleveland for the first time. There, Stark proposed to build Y-Cleveland, an incredibly grand vision. The Y represented a shaped on a map showing areas of downtown to be developed. The bottom of the Y would start on Scranton Peninsula. The right arm of the Y would extend over to the Campus District.

The left arm would reach up through the Warehouse District to the lakefront where Stark proposed to develop the surface parking lots and extend the street grid over the lakefront railroad tracks to the water's edge. He called that arm Pest (pronounced Pesht), a whole new city like Pest became to the older Buda, in Budapest, Hungary.

Stark was so committed to the idea that the firm relocated its headquarters from its Eton Collection development in east-suburban Woodmere to the Gilman Building, 1350 W. 3rd St. It partnered with parking lot owner Weston to achieve its grand vision. Stark had hoped to secure a development anchor in the form of one of the half-dozen or so large downtown firms that considered relocating from their aging office buildings. Alas, Stark was unable to reel in any of them.

So Stark moved on to nuCLEus in 2015. A year later, Weston joined with Citymark Capital to come up with its own big plans for the Warehouse District parking lots. But Weston's plans already had been on life support for a year or two when it sold the parking lots this spring to Sherwin-Williams Inc. for its new global headquarters.

|

A 2005 site plan for the upper-left arm of Y-Cleveland Stark's grand

vision for downtown Cleveland ending with "Pest" -- a new city

to complement downtown's existing central business district

and to better link downtown with the river and lake (Stark). |

Even as Stark continued to add to Crocker Park by building more residential, retail and securing the American Greetings headquarters, it was still stung by its failure to build Y-Cleveland and especially Pest. Stark may consider that project unfinished rather than abandoned. It still owns Warehouse District parking lots on West 9th. It built The Beacon apartment tower. And nuCLEus is still an active project.

PLAN EVOLUTION: This is one of the starkest differences between the two projects. One project's plan has grown since it was first announced while the other has shrunk. The growing project is Circle Square.

When it started as UC3, Circle Square was estimated to be a $225 million project, not including Fenway Manor. It since has grown to be a $300 million project with buildings originally proposed at eight stories growing to 11- to 13-story buildings, and 17-story apartment towers rising further to 24 stories. Add another $40 million with Fenway Manor's inclusion.

The reason for the growth is the success of other projects in University Circle including First Interstate's 20-story One University Circle. Midwest also contributed in 2018 by opening its Centric development. Although, first proposed to be larger than what was ultimately built, the project is considered to be a great success. Centric, despite having rents ranging from $2.29 to $3.18 per square foot, leased out 95 percent of its 272 apartments in one year.

That success attracted attention, including from out of town. With Circle Square, Midwest Development is joining forces with White Oak Realty Partners of Chicago which has a great deal of experience in building high-rise apartment towers in cities throughout the nation. White Oak is taking the lead on developing a 24-story tower at Circle Square, to rise on the site of the former police station, 10600 Chester Ave.

|

An updated Circle Square masterplan was approved by the City

Planning Commission earlier this month. It features taller apart-

ment buildings in the background along Chester Avenue with

an office building proposed in on the right side on Euclid

Avenue between Stokes and MLK boulevards (Midwest). |

Also, the mostly residential-retail/civic land uses at Circle Square added another use and more scale in its latest iteration. A 13-story office building is proposed to be built where Midwest had previously envisioned townhouses.

By contrast, Stark's original plan for nuCLEus has been scaled back from its catalytic goal. It wanted nuCLEus to be a globally prominent development whose catalytic impact on downtown would rival that of the Cleveland Union Terminal Group (topped by Terminal Tower) of the 1920s and 30s. It started out with a mammoth price tag of $500 million but has since shrunk to less than $300 million, although a current dollar value hasn't been announced.

While Circle Square grew and added planned uses, nuCLEus went in the other direction. In its first scale-down, it lost its hotel "bridge" between two towers, one of them the 54-story skyscraper. So by early 2019, nuCLEus was re-cast with two 24-story towers -- one residential, the other offices -- atop the parking/retail pedestal. The price tag shrank to $353 million.

The development was scaled back again in early 2020. NEOtrans broke the story that nuCLEus would shed the apartment tower and cut 60,000 square feet from the office building while adding a story to it. The skinnier office tower, still atop the parking/retail pedestal, would likely require an investment of less than $300 million to build.

That apparently matched the financing Stark had in hand to build nuCLEus. With most of the office tower pre-leased and a residential component still under consideration, Stark appeared ready to start construction in early 2020. Then the pandemic hit and put everything on hold.

|

The latest announced conceptual plan for nuCLEus shows a single,

skinnier, 25-story office tower over a pedestal of parking

and ground-floor retail uses (Stark).

|

There are companies seeking office space in and near downtown, but the newest arrivals want to move within a matter of months, not wait years that it will take to build a skyscraper. Others want their name atop a building, not play second fiddle to Benesch or anyone else. And while opinions vary, some real estate brokers who spoke off the record say Bob Stark and his son Ezra, now Stark's chief operating officer, are difficult to work with in getting lease deals done.

Stark also hasn't added partners to its development. To be fair, nuCLEus didn't start out with only Stark Enterprises' name on the marquee. It began as a partnership between Stark and J-Dek Investments. But make no mistake that nuCLEus is run by Stark.

Its previous project nearby was The Beacon -- downtown Cleveland's first new-construction residential high-rise since The Park (now Reserve Square) was completed in the early 1970s. The Beacon was a result of making lemonade from a lemon. The lemon was the 542-space 515 Euclid parking garage, built in 2005 for $26 million to accommodate a residential tower above it. Not only did the Great Recession halt plans for the tower, it put 515 Euclid's owner, AmTrust Financial Corp. into bankruptcy.

As part of the bankruptcy, the parking garage was sold at auction to the Harbor Group for a bargain $8.15 million. Stark partnered with Harbor Group to build the 19-story Beacon atop the 9-story garage that was full during the day but mostly empty at night when The Beacon's residents would park there. Few places downtown offered a low-cost parking garage that could be used to support a new residential tower (the planned City Club Apartments will use a similar arrangement at 720 Euclid Ave.).

But while Centric leased out in a year, Stark is offering up to six months free rent to try to fill up The Beacon with tenants. Granted, it's still early. The Beacon held its formal opening ceremony less than a year ago in November 2019 -- four months before the pandemic reached America.

|

While Circle Square's plan (at left) got bigger and more ambitious

and has a March 2021 target date for groundbreaking, nuCLEus'

plan got smaller and doesn't have a start date (Midwest/Stark).

|

And there are significantly more apartment units coming on the market in downtown Cleveland than there are in University Circle. That may not hold true for much longer, as Cleveland Heights adds new housing like The Ascent at Top of The Hill and Integrity House, Cleveland Clinic looks to enter the housing market while surrounding neighborhoods like Glenville, Hough and Fairfax restore their housing stock.

CONCLUSION: The short answer as to why Circle Square gets the love that nuCLEus doesn't comes down to the reasons why each gets their press coverage. Circle Square got headlines for mostly positive reasons; nuCLEus got headlines for mostly controversial reasons. Each time Stark sought a new public incentive idea to replace the last brainstorm, the media and its readers grew more skeptical.

Ironically, Stark's latest public incentive idea was arguably its best -- the TMUD tax credit. It has won broad support from developers, chambers of commerce, city officials and state lawmakers throughout Ohio. If it wasn't for the pandemic, the tax credit would almost certainly have become law by now. The legislation would have to pass by the end of this year for it to become law or the whole lawmaking process for the TMUD tax credit will have to start all over again.

So while Circle Square's developers are working towards a March 2021 groundbreaking per their latest plan, Stark has put nuCLEus on indefinite hold, awaiting an end to the pandemic to see which of its many retail and college housing properties emerge from the economic slowdown unscathed.

If Stark is able to get a groundbreaking date announced before Circle Square puts shovels in the ground, a lot of the criticism -- or at least skepticism -- Stark has received and continues to receive may go away. Given the extensive and fascinating history of cities, a timeline of decades or longer is not an unusual measuring stick for gauging a development of significant scale. After all, the Cleveland Union Terminal Group still isn't finished a century later.

END