|

A 25-story office tower on a pedestal of parking and

ground-floor retail appears to have more than enough

capital to afford its construction cost just above $200

million. That doesn't include the potential renovation

and expansion of the Herold Building which is just out

of view at the bottom-center of this image (Cresco).

CLICK IMAGES TO ENLARGE THEM |

As a follow-up to

last week's article in which NEOtrans broke the story about the new nuCLEus and Herold Building plans, there is an interesting back-story behind the new approach. It all centers on addressing the difficulty of constructing new office buildings in Cleveland.

Granted, putting up office buildings for tenants in Cleveland isn't Mission Impossible. It's more like Get Smart. Titles for those 1960s-era spy TV shows summarize Stark Enterprises' plans for One nuCLEus Place and its "Mini-Me," a renovated/expanded Herold Building.

The reason for creative approaches? Greater Cleveland is the nation's

15th-most expensive metro to build an office building yet the region has the nation's

third-cheapest office rents, eclipsed by only Albuquerque and Louisville.

According to EVstudio.com and adjusted for inflation, it costs more to build a 5- to 10-story office building in Cleveland than in Washington DC, Denver, Miami, Phoenix, Atlanta, Houston or Dallas.

The last new-construction office building to hit the leasing market was seven years ago -- the Ernst & Young Tower at 950 Main St. in the Flats East Bank development. Constructed was a 21-story, 487,000-square-foot, $145 million building. Even though it is 90+ percent leased and considered a "trophy-class" building, commanding some of the highest rents in Greater Cleveland at $30 per square foot, it couldn't be built without massive subsidies.

One of those subsidies -- the EB-5 Immigrant Investor Visa -- pumped $30 million into the capital stack for the Ernst & Young Tower. That program was since scaled back due to a

number of problems, although President Donald Trump proposed last month to

greatly increase the number of available visas and reduce the individual investment threshold necessary to get one.

|

Conceptual rendering for the interior of a renovated and

expanded Herold Building, 310 Prospect Ave. (NBBJ). |

There are few other subsidies available to push more office developments into central business districts even though there is a clear public benefit in doing so. Downtowns offer

accessible jobs to more socioeconomic groups because downtowns are located at the centers of highway and public transit networks.

Office tenants prefer new, Class A buildings but the only new-construction inventory being added is on less expensive suburban properties that are less accessible to minorities and the lower-income labor force. Suburban offices are also

less favored by young professionals, making it more difficult to recruit them.

Yet the City of Cleveland doesn't offer tax abatement for office developments as it does for residential. Although the state does offer them, the

City of Cleveland recently blocked an attempt by Harbor Bay Realty Advisors from getting a state-authorized property tax abatement.

After the city blocked it, Harbor Bay was able to regroup and get property tax abatement from the city for the housing component of the project. So while the residential portion is

moving forward, the office component was set aside for a later phase.

Until recently, the only office developments getting any traction in downtown Cleveland involved

redevelopments of historic properties. These office redevelopments can get the most subsidies -- namely a variety of state and federal historic tax credits, as well as new-market and job-creation tax credits.

Relying on historic restorations to add new office inventory will change with the new Sherwin-Williams (SHW) headquarters on Public Square. The 1-million-square-foot first phase of this development, not including parking, is unlikely to include any for-lease space.

Future growth of SHW's headquarters won't be accommodated by overbuilding the Public Square tower and temporarily leasing out the remainder. Instead, SHW parking structures built on the Superblock bounded by Superior-St. Clair-West 3rd-West 6th will reportedly be designed with the ability to add future phases on top of them or next to them.

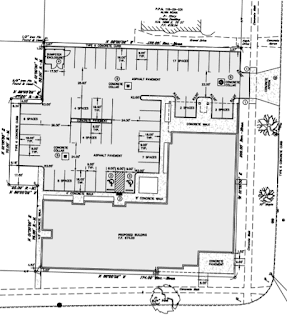

|

New site plan for nuCLEus which also shows the ground-floor

plan for the Herold Building at the upper-left (Cresco). |

That brings us to nuCLEus and the Herold Building.

In 2014, Stark Enterprises acquired from Los Angeles-based L&R Group of Companies two basic agglomerations of downtown properties for $26 million. One was a 2.33-acre parking crater at West 9th Street and St. Clair Avenue in the Warehouse District. The other was 2.3 acres of land that included a parking crater and several neighboring structures. J-Dek Investments Ltd. joined Stark in a partnership called Gateway Huron LLC in acquiring the latter group of properties.

The exception in the latter group was the Herold Building, 310 Prospect Ave., constructed in 1906 and expanded in 1908 to 300 Prospect by Oscar and A. B. Herold, owners of the Herold Brothers barber supply store on Public Square. The Herold housed the American Federation of Labor headquarters over Wilson's bird store and the Pilsener Brewing Co., according to its

2013 landmark registration,

Kurtz Furniture acquired the Herold in 1920 and modernized the facade with structural glass panels in 1948. Kurtz closed its downtown store in the 1970s. The building has since housed two ground-floor restaurants -- the Clock Restaurant and Downtown Eddie's -- but the upper floors have remained largely vacant for decades. The city condemned the building in 2010.

L&R had hired Benesch, Friedlander, Coplan & Aronoff and filed suit to overturn the city's denial of its demolition request. The case was withdrawn when Stark acquired the Herold. L&R was only too happy to get rid of the Herold, pocketing $1 million in the process. Stark pledged to renovate the Herold, only to change its mind after five more years of structural decay.

Stark and its demolition contractor requested approval in August 2019 from the Downtown-Flats Design Review Advisory Committee to raze the Herold. It had no post-demolition plan for the site, so Ward 3 Councilman Kerry McCormack urged the request be tabled until Stark could come back with a plan.

But Stark merely wanted the condemned Herold gone. It was proposing the $353 million nuCLEus mega-development next door and needed a construction staging area for it. So Stark came back to the design-review committee on Sept. 5, 2019 with a site plan showing a grassy lot. The committee wasn't impressed. It blasted Stark for not coming up with a more creative outcome for the property.

|

Office stacking in the revised plans

for the nuCLEus development (Cresco). |

Apparently Stark felt it should get a pass from the city because Stark was planning 1.2 million square feet of development on one of downtown's largest parking craters. But the city wasn't about to ignore its

own laws in accepting or rejecting a proposed demolition of an historic building with a landmark registration, located in an

historic district.

Rebecca Molyneaux, vice president of development at Stark Enterprises, told the committee it would cost $6 million merely to address the code violations and remove the Herold Building's condemnation. It could cost another $1 million to mothball the structure or millions more to renovate the building into a marketable property.

Tom Yablonsky, executive director of Historic Gateway Neighborhood Corp., asked Molyneaux if Stark had considered a myriad of tax credits available for the Herold. If Stark had, it didn't apply for them. So the committee voted 7-3 to reject Stark's demolition request.

The committee's vote wasn't binding. It serves as an advisory panel to the full Planning Commission where decisions are legally binding. Stark was on a path to get its demolition request formally shot down by the commission on the following day.

Right after the design-review panel advised against Stark's request, Yablonsky made a bee-line for the Stark reps and reportedly reached out to them with a way to save the Herold. But it ended up doing more than that. It may have saved nuCLEus as well.

The megaproject next-door had been

languishing for six years. It began as a $500 million, 54-story structure with a hotel bridging between office and residential buildings, above a pedestal of parking and retail. It was succeeded by second version that retained the retail/parking pedestal but perched atop it two separate 24-story towers of office and residential, costing $353 million.

|

This was the old floor stacking plan for nuCLEus, with

the office building at right and the residential building

to the left of it (Stark). |

But because of Cleveland's high construction costs and low rents, Stark tried a variety of creative public funding schemes to bridge the gap between its design and available capital. None were embraced. The schemes were too innovative for Cleveland's reactive, parochial public entities to wrap their heads around.

So Stark went to state legislators in Columbus with a new public funding idea -- the

Transformational Mixed Use Development (TMUD) tax credit. It won support from state-wide economic development organizations and other developers, but was amended multiple times by legislators to win more political support from around the state.

After two years of bouncing around the statehouse, the TMUD tax credit bill appeared in February to be weeks away from moving out of the Ohio House of Representatives and onto the governor's desk for his signature. However, the COVID-19 crisis put a stop to that, and now the fate of the bill is unknown.

Before the TMUD legislation got put on the shelf,

rumors were emerging that nuCLEus had more than just a pulse. It might even be a fully funded project without the TMUD tax credit and

could see construction start as early as this summer.

Then, earlier this month,

new plans for nuCLEus were released publicly. They showed that Stark was willing to do some creative value engineering to build something that aligned with the capital in hand. The rumors about Stark having the resources to move forward on a slimmed-down nuCLEus were confirmed by two high-level sources who were not authorized to speak on the record.

COO Ezra Stark declined to comment.

Stark eliminated or delayed the 24-story apartment building, estimated to cost more than $100 million, from the project while hanging on to the office building. Although the office tower will remain at 350 feet tall, its floor count will grow by one story to 25 stories. Stark will add two more levels of offices by adding that floor to the tower and by shrinking the amenity deck on the roof of the eight-story parking-retail pedestal.

|

| Location of nuCLEus in the central business district (Cresco). |

Stark is also shrinking the size of the floorplates in the office tower by about 500 square feet. A skinnier office tower will offer 60,000 fewer square feet compared to what Stark had proposed previously. At about $300 per square foot, that's a savings of roughly $18 million.

Stark has commitments from potential office tenants for about 250,000 square feet of space in the skinnier building. In other words, roughly 73 percent of the building is already spoken for. The anchor tenant is the fast-growing law firm Benesch which would take about 180,000 square feet. Stark Enterprises' headquarters would also be a tenant. Other office tenants are unknown.

Benesch needs that space to become available by the summer of 2022. That's when its current lease at 200 Public Square runs out. Benesch and its timeline are why the developer wants shovels in the ground for nuCLEus by fall. They're why Stark shed the apartment tower from nuCLEus and retained the office tower.

At the same time, the developer is increasing the amount of ground-floor commercial use in the parking deck by 25,180 square feet to 103,000 square feet, adding several million dollars more in costs there.

The end result of all of these changes is that Stark could be saving anywhere from $115 million to $140 million from the cost of nuCLEus, potentially bringing the project's cost down from $353 million to as low as roughly $210 million.

In mid-2019, the developer publicly released a simplified breakdown of its capital stack, showing that it had about $294.5 million in private debt and equity. A previously established tax-increment financing arrangement with the city adds another $19 million. Publicly funded loans and aid, already committed, brings another $26.5 million. In its previous plan, Stark had a nearly $15 million gap in its capital stack which it had hoped to fill with a TMUD tax credit.

|

The Herold Building is in the middle of this view, looking east

down Prospect Avenue. The former Record Rendezvous, 300

Prospect, is at the right (Google). |

In other words, the developer now apparently has more than enough resources to move forward on the slimmed down nuCLEus. But let's not ignore the Herold Building's role in all of this.

A future Herold Building project is allowing Stark to reduce the size of his nuCLEus office building, and thus reduce its construction costs. It is also allowing Stark to deliver brand-new Class A office inventory in One nuCLEus Place that is about 73 percent pre-leased before shovels hit the ground. Lenders have to love that.

There are some public incentives that Stark can get by repairing and renovating the condemned Herold Building, but the developer risks losing them if it expands the Herold Building as shown in a rendering in a recent marketing piece.

There are ways of working around the incentives' restrictions, but they involve more complications than a basic historic renovation project. The complications are likely why Stark isn't aggressively marketing the Herold Building right now.

Consider the land area of the Stark-owned Herold Building at 310 Prospect and a neighboring vacant lot at 320 Prospect. The latter is owned by the same Stark/J-Dek partnership Gateway Huron LLC that owns the land on the other side of East 4th Street where nuCLEus is planned. Together, their combined land area is 8,000 square feet.

If the Herold is repaired, renovated and expanded as shown in the marketing piece -- as an eight-story building with 8,000-square-foot floorplates except for the top floor which is about half as large and set back from the street facade -- it would measure about 60,000 square feet. That's the same amount by which Stark had reduced the size of its One nuCLEus Place office tower.

Such a building could cost about $25 million to repair, renovate and construct. Stark may have the resources to do it now, based on the cost savings and capital stack from nuCLEus. But the developer may not be able to expand the Herold as shown in the marketing piece.

|

Rendering of the expansion of the Herold Building as an

eight-story office building. The nuCLEus development

is just out of view to the left (NBBJ). |

The reason is that, even with structural repairs, the Herold was designed to accommodate only two more stories above its existing four stories, according to its historic registration. Internal structural supports would have to be added to the building. And, if historic tax credits are used, they limit how the existing building can be altered, said historic preservation consultant Steve McQuillin.

"While I don’t hate plans to add floors to the top of (the Herold Building), it’s hard to see how that will meet the (historic) standards and thereby qualify for state and federal preservation incentives," he said.

For example, a non-competitive federal historic tax credit would likely require any vertical expansion of the Herold Building to be set back from the original facade so as to not be visible from the street.

There is a post-construction review and inspection by the National Park Service. If the building is changed in any way within five years after completion so that it doesn't meet federal standards, the project could lose the tax credit.

State tax credits, which have no post-construction review and pull-back provisions, could be used instead. But they are competitive and therefore more difficult to get, McQuillin said. If the state tax credit was used to repair and renovate the Herold Building, Stark could then sell the air rights post-renovation to Huron Gateway LLC for $1 for an expansion of the Herold.

While the National Park Service reviews projects seeking federal historic tax credits, the Cleveland Landmarks Commission reviews projects seeking state historic tax credits. That's another reason why Stark may want to apply to the state even though it wouldn't be guaranteed to receive its state tax credits, McQuillin said.

|

View and summary of One nuCLEus Place office tower and

its parking/retail pedestal (Cresco). |

"Unfortunately the Landmarks Commission isn’t that strong," he said. "It’s true they did oppose demolition (of the Herold) in 2014 by a different, less connected developer. But they’d be flexible with Stark. The National Park Service won’t be."

Just west of the Herold Building are several more decaying, low-level buildings. One of them, 300 Prospect, is

listed for sale. It was the 1908 expansion of the Herold Building and, up until 1920, was connected internally through to the Herold Building.

The owners of 300 Prospect, a joint venture between the Weston Group and Bobby George, reportedly would take the building off the market and redevelop it if nuCLEus goes forward, said a source who spoke off the record because he wasn't authorized to speak publicly about it. The vacant building, once home to

Record Rendezvous, served as one of the cradles of Rock n' Roll.

Although Stark wants to move forward on nuCLEus before fall, that will depend on when the City Planning Commission's review panels can meet again -- either in person or virtually.

The

COVID-19 crisis and the City of Cleveland's lack of virtual meeting technology is preventing design-review panels from meeting and acting on submitted plans. When those review panels do meet again, they will be asked to approve nuCLEus' revised conceptual, schematic, landscaping and signage plans. The latter two can wait until after construction starts, however.

But it looks like Stark has turned what seemed like Mission Impossible into a smarter match among resources, rents, renderings, renovations and reality. And those just might replace another downtown parking crater with new investment, jobs and urban vibrancy.

END