|

Stark Enterprises wants to get started on building nuCLEus to

meet the timetable of its anchor tenant. So the Cleveland real

estate developer has slimmed the planned office building and

removed the apartment tower to trim more than $100 million

from the prior plan's $353 million construction cost (Cresco).

CLICK IMAGES TO ENLARGE THEM

|

If at first you don't succeed, try, try, try again.

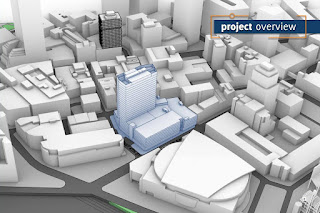

Stark Enterprises has publicly released a third iteration of its proposed nuCLEus development. And sources say that Stark has the resources to move forward with a groundbreaking based on this plan as soon as the

city's design review boards can meet again and act on it.

This version eliminates or delays residential in the project, now focusing on a single tower for offices only, rising above a large parking deck with ground-floor retail. Each new mixed-use concept by Stark for nuCLEus has eliminated a use from the prior variation.

The first, 2014 version was envisioned as a $500 million, 54-story structure with a hotel bridging between office and residential buildings, above a pedestal of parking and retail. The second version retained the retail/parking pedestal but perched atop it two separate 24-story towers of office and residential, costing $353 million.

The pedestal remains as does one tower -- an office building called One nuCLEus Place. But it would stand alone atop the far north end of the pedestal. Spaces were left open atop the east and south portions of the pedestal, perhaps for a future residential tower to rise someday.

|

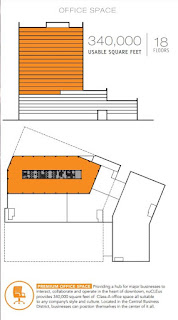

The office tower, named One nuCLEus Place, would rise 25

stories and feature 340,000 square feet of Class A space, 73

percent of which is already spoken for, Stark says (Cresco). |

E-mails sent to Stark Chief Operating Officer Ezra Stark seeking more information were not returned prior to publication. He acknowledged receiving them, however.

Stark is seeking to get shovels into the ground this summer for the office tower-only plan for a pressing reason. Its prospective anchor tenant, Benesch, Friedlander, Coplan & Aronoff, one of the region's largest and fastest-growing law firms, is quickly approaching the end of its lease at 200 Public Square. That lease will

expire in July 2022.

It will take about two years for the pedestal and office tower to be built. But Stark executives apparently aren't worried about losing Benesch to another building in downtown Cleveland. They said they're worried about losing them to another city such as Chicago or San Francisco where Benesch also has offices.

Stark executives

said recently they are concerned that Benesch will go the way of other major Cleveland law firms like Jones Day and relocate their growing number of employees to larger cities. A trophy office building could be a major recruiting tool for Benesch, Stark executives said in recent media interviews.

|

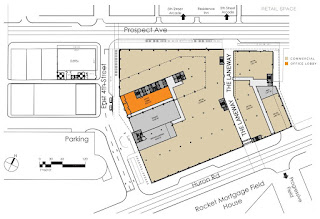

New site plan for nuCLEus shows the ground level uses, most

of which are for the 103,000 square feet of retail and restaurant

uses. The plan preserve the "laneway" linking Prospect Avenue

and Huron Road. But it also shows the Herold Building, at 310-

320 Prospect, expanded as an office building with a larger foot-

print and a vertical addition giving it eight stories (Cresco). |

Benesch pledged to take 180,000 square feet of office space at nuCLEus. Another 68,000 square feet of office space was spoken for by other potential tenants, including Stark Enterprises for its headquarters. In total, those tenants would have filled 62 percent of the previously planned, 400,000-square-foot nuCLEus office tower.

But the new nuCLEus office tower is proposed to be 340,000 square feet. With the commitments in hand, Stark has 73 percent of that building already spoken for.

Another factor involved in Stark's desire to move forward immediately is the

historically low interest rates. The low "cost of money" reduces the cost of borrowing for construction projects. For those projects like nuCLEus that have been just shy of their capital financing goals, low interest rates can help them stretch over the fiscal finish line.

There is no publicly available construction cost estimate for the new nuCLEus plan yet. Stark had all but about $15 million in hand or pledged to build the previous version -- a gap which it had hoped to fill with a Transformational Mixed Use Development tax credit, the legislation for which is pending in the Ohio General Assembly but

stalled because of the COVID-19 crisis.

|

This image, showing the outdoor greenspaces on the rooftop

of the parking garage, is oriented with north at the bottom.

The top, or south side of the deck, may be reserved for a

future building such as apartments, hotel or additional

offices atop the parking structure (Cresco). |

Eliminating or delaying the apartment building from the project certainly helps Stark deliver the rest of nuCLEus sooner. Although the cost of the discarded apartment tower isn't publicly known either, it represents a hefty savings.

For comparison, Stark spent $95 million building the 19-story, 187-unit, roughly 260,000-square-foot Beacon apartment tower atop the existing, 9-story 515 Euclid garage a block away. That tower was completed last year.

And, at Euclid Avenue and East 17th Street, the Playhouse Square Foundation is spending $138 million to build the 34-story, 318-unit, 602,000-square-foot Lumen Apartments and associated 550-space garage. This tower is scheduled to receive its first residents in June.

Based on the scale of those projects and their construction costs, less the cost of a garage, nuCLEus' discarded 250-unit apartment tower would have measured about 350,000 square feet and cost upwards of $100 million to build.

|

Outdoor greenspaces on the roof of the parking garage would

provide private terraces for the fourth-floor office tenant while

the eighth-level observation deck would open to all tenants of

One nuCLEus Place office tenants (Cresco). |

According to a presentation made publicly available by Stark's real estate brokerage Cresco within

One nuCLEus Place's listing, the new design for nuCLEus shows a still-large development totaling roughly 1 million square feet among all proposed uses including parking.

That breaks down to 340,000 square feet of highly sought after Class A office space downtown, 103,000 square feet of retail and 34,000 square feet of amenity space. Despite the office building's reduction and the elimination of the 250-unit apartment tower, the number of parking spaces in the six-level deck would remain roughly the same at 1,375 parking spaces, equaling about 450,000 square feet.

One nuCLEus Place would rise on 2.18 acres of land owned by a partnership of Stark and J-Dek Investments Ltd. Most of that land is used for parking, totaling 600 spaces in a surface lot and a 7-level garage on Huron Road that would be demolished. Also succumbing to the wrecking ball would be a two-story commercial building on Prospect Avenue featuring Mr. Albert's Mens World clothing store.

It's interesting to note that, when compared to the previous plan, Stark seeks to decrease the amount of office space from 400,000 square feet to 340,000 square feet while increasing the height of the remaining high-rise by one story to 25 floors. The number of office floors within that high rise would also increase from 16 to 18 while the new floorplates are about 500 square feet smaller. The building's height would remain at 350 feet, however.

|

One nuCLEus Place is a 25-story

tower (18 floors of offices atop a

seven-level pedestal of retail and

parking). Compared to the previ-

ous design for nuCLEus' office

tower, the new version is a little

skinnier but is the same height in

feet but one story taller (Cresco). |

On the other hand, the amount of retail Stark proposes would increase from 77,820 square feet to 103,000. No retail tenants were announced or names otherwise depicted in the new nuCLEus presentation. Cordish Companies

previously pledged to lease 48,000 square feet for a sports-entertainment venue called Cleveland Live! at nuCLEus.

While Stark retained a "laneway" -- an alley lined with shops, restaurants and courtyards -- in its new design, it abandoned the idea of opening up East 4th south of Prospect to pedestrians. The first nuCLEus plan would have closed East 4th to vehicular traffic between Prospect and High Street. The second plan narrowed East 4th as a southbound-only, one-lane street. The new plan has East 4th as a two-way street south of Prospect.

In one of the e-mails to Stark, NEOtrans also inquired about a rendering recently posted on the real estate listing service LoopNet, showing a renovation and expansion of the historic but vacant and condemned Herold Building, 310 Prospect Ave.

As shown, the four-story Herold Building would become an eight-story building, and expanded laterally on to the neighboring parking lot at 320 Prospect. The Stark/J-Dek partnership also owns the Herold Building and the parking lot at the southwest corner of Prospect and East 4th. Expanded, the Herold Building would be about 60,000 gross square feet -- possibly accounting for the 60,000 square feet reduction of One nuCLEus Place.

|

Stark and J-Dek Investments propose to expand the Herold

Building vertically (by four more stories -- note the eighth

story is set back) and horizontally onto a parking lot at East

4th Street and Prospect Avenue (NBBJ Architects). |

Last summer, Stark sought to demolish the Herold Building but was turned down by the Landmarks Commission. The Historic Gateway Neighborhood Corp. offered to work with Stark on securing tax credits and other financing to help rehabilitate the building.

Tom Yablonsky, executive director of Historic Gateway, did not return a phone call and an e-mail seeking more information prior to publication.

An expanded Herold Building is proposed to be renovated and expanded as an office building with a ground-floor retail or restaurant space, according to the new site plan for nuCLEus. It specifically identifies an office lobby entrance off East 4th and a 5,895-square-foot ground-floor retail space. The Herold site is across 4th Street from the nuCLEus site.

Just west of the Herold Building are several more decaying, low-level buildings. One of them, 300 Prospect, is

listed for sale. The owners, a joint venture between the Weston Group and Bobby George, reportedly would take the building off the market and redevelop it if nuCLEus goes forward, said a source who spoke off the record because he wasn't authorized to speak publicly about it. The vacant building, once home to

Record Rendezvous, served as one of the cradles of Rock n' Roll.

END