|

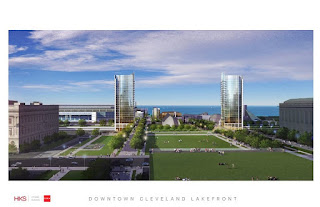

Is a multi-building urban campus totaling 1.8 million square

feet, plus a large parking ed parking, be in the cards for the

7 acres of surface lots to the west of downtown Cleveland's

Public Square? Or will it be somewhere else? (Geowizical)

CLICK IMAGES TO ENLARGE |

For those of us who were expecting Sherwin-Williams' (SHW)

new global corporate headquarters plus research and development facility to be Cleveland's newest, tallest skyscraper, we may be disappointed. That's more of a statement of about what the new HQ+R&D might look like than where it might be built.

In fact, in its recent

Request For Qualifications from the Cleveland offices of two international construction management firms (CM), SHW has asked for their conceptual proposals for downtown Cleveland facilities only, according to a high-level source. Those proposals were due to be submitted today.

That source, confirmed by another, said that SHW's real estate broker, CBRE, hasn't reached out to any other U.S. or international offices of those two CM firms -- Turner Construction Co. and Gilbane Building Co.

SHW's project development process is highly compartmentalized. The Fortune 500 company, through CBRE, has separately reached out to downtown Cleveland property owners to discuss their asking prices and possible partnerships. Unfortunately, all of the sites aren't yet known.

On another track, SHW is working with Vocon Partners LLC to develop architectural concepts of potential developments involving those sites to accommodate approximately 6,000 office and research workers.

And on yet another track, SHW is reaching out to suppliers, many of them in Northeast Ohio, for design concepts and cost estimates for everything from office decorations to amenities to furniture.

|

Goodyear's headquarters in Akron offers an example of what

SHW's CEO John Morikis reportedly likes in a large office

building for 6,000 of his company's employees (Goodyear). |

However, SHW is also accepting unsolicited proposals from other real estate owners and developers for places outside of downtown Cleveland and, indeed, from outside of Ohio, two sources said. Another source said that the proposals will have to include "significant" incentives to offset SHW's costs of relocation.

In other words, SHW will stay in Cleveland, and especially downtown, unless some other city makes SHW an offer it can't refuse and Cleveland can't at least match it.

Yet another source notes that Greater Cleveland goes through at least one of these big corporate competitions per year. This year, it's SHW's HQ+R&D. Last year, it was Swagelok's new HQ. The year before, it was Amazon's HQ2. Greater Cleveland has one win and one loss in that time, although Swagelok was as unlikely to leave Northeast Ohio as Amazon's HQ2 was to come here.

The source says the public-private sector here isn't taking any chances on whether SHW is seriously considering leaving Greater Cleveland or even the City of Cleveland.

As with recent efforts, the source says there will be a "full court press" to keep SHW in Cleveland, led by Gov. Mike DeWine, former Forest City Enterprises CEO Albert Ratner and the Greater Cleveland Partnership.

As a result of its extensive and compartmentalized due diligence, SHW's staff and board has received a great deal of detail from the respondents as to what the downtown Cleveland headquarters could look like. The extent of detail ranges from the overall physical form at the optional downtown Cleveland locations, right down to the interior finishes.

Interestingly, the overall physical form may not be the focus of many Cleveland skyline postcards. Why? To understand that, we need to understand SHW's leadership and corporate culture.

|

In contrast, Eaton Corp.'s HQ in Beachwood didn't gain a

fan in Morikis after he visited it and other corporate offices

throughout Northeast Ohio (Pickard Chilton). |

CEO John Morikis has been a SHW employee since he got his master's degree from National Louis University in Chicago. He studied business and psychology. He worked his way up through SHW's ranks since 1984. He has embraced his company's conservative, non-pretentious approach. And he is well aware of the company's deep Cleveland roots.

Armed with an understanding of psychology, business and what employees at multiple strata experience, he is now tasked with coming up with new HQ+R&D facilities that affect everything from the employees' mood, to their sense of belonging, to their innovation and to their productivity.

For those reasons, Morikis doesn't seem interested in setting a new height record for a downtown Cleveland skyscraper or building anything iconic merely for the sake of bragging rights, according to those working around him on this project.

In fact, when SHW first started working with century-old law firm Kohrman Jackson & Krantz on drawing up the RFQ one year ago, it initially assumed that the tallest building in the HQ complex would be a 40-story skyscraper.

While that sounds like a big building, the space requirements in the RFQ are far bigger -- 1.8 million square feet, divided among a roughly 1.45-million-square-foot HQ and a 350,000-square-foot R&D facility.

If the HQ was put in a single building with floorplates similar to those of Cleveland's Key Tower, SHW's HQ would be taller than Key, currently the tallest building between Chicago and the East Coast.

|

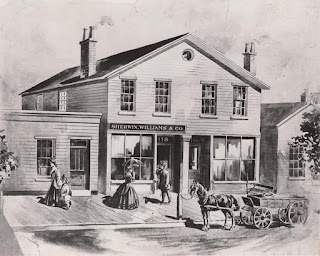

An artists' rendering of Sherwin-Williams Paint Co.'s first store

store at 118 Superior Ave. -- on Public Square in downtown

Cleveland in 1866. This is near the site SHW favors for its

new global headquarters and research center (SHW). |

But, apparently Morikis has no interest in challenging Key Tower's reign. Instead, he reportedly envisions a multiple-structure urban campus with at least one tower, but none taller than 40 stories.

He seems to want a campus that is connected, collaborative, energizing and uplifting, rather than one or two buildings that are so confining that employees rarely step outside to recharge their batteries until their workday is done.

There are several large sites within downtown Cleveland where such an urban campus can be built without having to deal with multiple property owners and undertaking significant demolitions. The sites would have to be large enough so that SHW can spread 1.8 million square feet (not including parking) among multiple buildings.

Not many people realize how much land SHW owns along the Cuyahoga River -- 9.2 acres. It is where SHW's John G. Breen Technology Center is located now and where SHW was founded 153 years ago. It would be a beautiful and historic site for a SHW HQ+R&D, but only if construction could be undertaken in stages without disrupting the Breen Center.

The other that is more well known is on the west side of Public Square, near where SHW established its first store in 1866. The site starts with the 1.17-acre Jacobs Group-owned parking lot on which Ameritrust planned to construct a 60-story, 1,198-foot-tall headquarters in 1989 until the former Cleveland Trust Bank was acquired by Society Bank which then merged with Key Corp.

That site continues into the 5.6-acre Weston Group-owned Superblock, bounded by Superior and St. Clair avenues, as well as West 3rd and West 6th streets. Combined, the 6.77 acres of parking lots would provide the site for a connected, urbanized office campus that is fully integrated into the amenities of a major city's central business district, including a newly refurbished Public Square.

|

SHW's Center of Excellence on the ground floor of its current

downtown Cleveland headquarters, located in the SHW-owned

Landmark Office Tower in the Tower City Center complex. It

has been headquartered there since 1930 (WKSU). |

A high-level source said

this site is favored by SHW because it was the chosen site for SHW's HQ when the company did extensive due diligence for it in 2014-15. Since then, and including Morikis, SHW's 11-member board of directors has four new people, replacing three. Also, Lead Director Steven Wunning joined the board late in that HQ process in 2015.

But Morikis was the chief operating officer until the end of 2015, ranking below only CEO Christopher Connor. Morikis oversaw the

last HQ development effort that was temporarily halted by SHW focusing resources on the acquisition of competitor Valspar Corp.

Morikis' leadership and recommendations on how to proceed with the HQ+R&D project will be very important to SHW's board. Morikis has visited an unidentified number of Fortune 500 company HQs in the region to learn what those companies' executives, managers and staff like and don't like about their facilities. And he reportedly soaked up the atmosphere and designs and finishes of each.

So when Morikis visited

Eaton Corp.'s 2012-built HQ in Beachwood, he "hated" it, primarily due to its finishes and atmosphere, a source said. Its isolated, car-dependent, 53-acre setting wasn't what he apparently hated. Instead, he was looking at how employees related to the building's design, materials and furnishings, once they were inside.

Conversely, he liked the atmosphere and finishes in the

Goodyear Tire & Rubber Co.'s 2013-built HQ in Akron, just down the street from where the company was founded in 1900. Apparently that building energized him. Richard Kramer, who has served on SHW's board since 2012 and also serves on Goodyear's board, shared with Morikis his experiences in building a new global headquarters.

After today's deadline, solicited proposals for downtown Cleveland HQ+R&D sites and any unsolicited proposals for sites outside of downtown will be reviewed by SHW staff with presentations to the board likely in the coming weeks and months.

If that schedule holds, the new HQ+R&D project could be announced at SHW's annual National Sales Meeting in Kissimmee, Fla. in January 2020. Or, considering how fast this project is moving, the announcement could come even sooner.

END