|

A request for qualifications sent to a few construction manage-

ment firms in Greater Cleveland for building a new headquarters

and research center for Sherwin Williams may indicate that the

global coatings giant is taking a serious step forward. But is

there another message in the issuance of an RFQ to so few

firms? (Bobek) CLICK IMAGES TO ENLARGE THEM. |

Unless the economy does a crashing repeat of 2008 in the next 6-12 months, Sherwin-Williams (SHW) could make a significant announcement about its headquarters (HQ) as well as it research and development (R&D) facilities by the end of 2020. Even a modest economic downturn is unlikely to put a stop to a multi-year process that has already started.

That process suggests that SHW is on a schedule that could have them start construction on a new HQ and R&D project by 2022. And some aspects of the process point toward downtown Cleveland as the site for most, if not all of this massive project.

According to a source, a Request For Qualifications (RFQ) was sent to a small number of construction management firms in Greater Cleveland for the construction of a new headquarters and research center for Sherwin-Williams. The source didn't identify which firms received the RFQ, but it was reportedly sent by SHW's real estate broker CBRE.

An RFQ is intended to reduce the number of bidders on a project to only those with the expertise to qualify for the project. So then why issue it to so few firms to start with?

A logical assumption is that an RFQ was issued because SHW needs a highly specialized construction manager. Furthermore, considering that so few firms received the RFQ, it suggests that SHW apparently needs a level of expertise that few local construction management firms have.

What expertise? It isn't known for certain, but the temptation is point to firms that know how to build supertall skyscrapers, like those that reach up to 900 feet tall and require caissons excavated 200 feet down to Cleveland's bedrock.

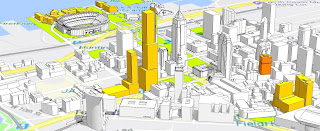

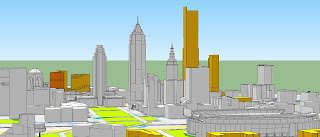

|

Could the two tallest proposed buildings in this graphic be the

approximate size of a new Sherwin-Williams headquarters and

research facility over parking? Before this rendering gained a

new life and more buildings as part of Cleveland's promotional

efforts to attract Amazon's HQ2, it apparently was SHW's plan

in 2015 for a new HQ on Public Square (GCP). |

The source says that the RFQ specifies the project will measure 1.8 million square feet. That's even larger than the last report of 1.6 million square feet, likely due to SHW's rapid growth.

Either number is large enough to mean that the project includes both the HQ and the R&D. It doesn't mean they'll be in the same building or even on the same property. But it does mean they could be part of the same construction bid.

Another source says that if an office campus of shorter buildings for an HQ+R&D near downtown or in the suburbs was under serious consideration, then the RFQ probably would have been sent to many more local construction management firms. It apparently wasn't.

That all leads to the next big question: where would the HQ+R&D be built? The RFQ apparently didn't identify the project's location except that it would be in the Greater Cleveland area and it would total 1.8 million square feet. The construction firm, when selected, will then presumably learn where the project will be built.

Vocon Partners, LLC is reportedly designing conceptual alternatives, including for different locations downtown. It isn't publicly known where those sites are. One site that is likely to be strongly considered is the site where SHW planned in 2014-15 to consolidate its scattered offices -- the Jacobs lot on Public Square.

|

The Jacobs lot on Public Square, as seen in 2014. This parking

lot has occupied the west side of the square for 30 years and

measures 50,974 square feet or 1.17 acres. Another 6 acres

acres of surface parking on the Weston Group-owned lots

is visible beyond (Google). |

Considering that more than one alternative site is in play downtown is also a good sign for those who believe SHW's HQ+R&D should stay in the central business district. And it's a good sign that the project would consolidate other offices and R&D activities from around Greater Cleveland and Minneapolis in downtown Cleveland.

Councilman Kerry McCormack, whose Ward 3 includes downtown Cleveland, didn't sound terribly worried about SHW leaving downtown Cleveland for the suburbs.

"We're in good communication with Sherwin-Williams," he said. "We'll do whatever it takes to keep them. But companies that want to attract talent are looking at moving into cities, not leave them."

While there are a lot of moving parts at work here, and based on the timeline of past projects, it is possible that facility conceptual designs, programming, infrastructure and other components could be ready for delivery to a city's planning commission in as soon as a year from now.

SHW representatives would likely request approval of conceptual plans, then refine them into more detailed schematic designs. Approval of the conceptual plans will first require releasing them publicly. That's when the public will probably get its first official notice of the project. The 6,000 SHW employees involved, as well as civic-minded Clevelanders, will have to wait until then.

Thankfully, at least SHW is

no longer officially denying that there may be an HQ+R&D project on the horizon. They've confirmed

they are analyzing their HQ space needs, but are peddling the theme that they do such analyses regularly. That's pretty unlikely considering the last time SHW moved into a new HQ building was 1930.

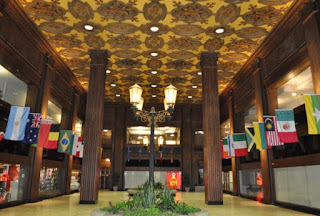

|

Sherwin-Williams' Center of Excellence is located inside its

existing headquarters building, the Landmark Office Tower.

The flags represent each country in which SHW has at least

$1.5 million in annual sales. The center has displays on the

company's 153 years of business, all of it headquartered in

downtown Cleveland (WKSU News). |

It's also unlikely based on the post-2014 spread of SHW offices to

several facilities beyond its aging, 900,000-square-foot

Landmark Office Tower HQ where employees have complained of uncomfortable climate controls, lack of open floor layouts and even roaches. SHW's apparently random leasing of additional offices since 2014 doesn't scream "coherent plan."

Offices are located among three non-contiguous floors totaling 51,810 square feet in the

Skylight Office Tower, a remodeled 151,830-square-foot flex space at

4780 Hinckley Industrial Parkway in Cleveland, as well as in 30,000 square feet of the

Automotive Finishes Corp. facility, 4440 Warrensville Center Rd. in Warrensville Heights.

That doesn't include the 140,293-square-foot Breen Technology Center in downtown Cleveland and the former Valspar Applied Science & Technology Center in downtown Minneapolis. That complex includes several renovated historic structures and totals more than 170,000 square feet.

If combined into a new facility that offered more elbow room plus space for future expansion, it could mean an

R&D center of 330,000 square feet or more. Parking for thousands of employees and visitors would add roughly 350 square feet per parking space in a multi-level structure. It isn't publicly known if the 1.8 million square feet figure for the HQ+R&D includes parking.

What is known is that SHW's debt burden from the 2016-17 Valspar acquisition is shrinking at an increasing rate. Six months ago,

SHW had been on a glidepath to get its long-term debt-to-equity (D/E) ratio down to 2:1 by December 2019.

But it's already five months ahead of that pace. Last year, SHW looked like it would reduce its long-term debt to $8.12 billion by June 30, 2019. Instead, it fell to $7.2 billion. Shareholder equity is only slightly below where it was destined to be on June 30. It was on target to be about $3.77 billion. Instead it was at $3.75 billion at the mid-year point.

SHW debt-to-equity ratio on June 30 was already below 2:1 -- at 1.92:1, thanks to strong cash flow from the Valspar acquisition.

According to second-hand sources, SHW officials have said that the company wouldn't consider building a new HQ until its debt was down to reasonable levels. "Reasonable" may well mean the coatings industry average of a 1:1 D/E ratio.

Last year, it appeared SHW was on a glidepath to hit that 1:1 D/E ratio at the end of 2022. But if cash flow continues to be strong and shareholder equity continues to rise steadily, SHW should get its D/E down to 1:1 in a little more than two years from now.

That's roughly when the planning, programming, design and procurement should allow for construction of the HQ+R&D facilities to begin. Fingers crossed.

END