|

| Click to enlarge all graphics (Google). |

A skeptical Clevelander would look at the above map where five potential major real estate developments may rise atop the West Rim of the Cuyahoga River valley and question how many will actually get built. An optimistic Clevelander would be certain that most, if not all, will get built. And an older, lifelong Clevelander would look at that map and be amazed that there are five potential major projects at all.

Then again, some may argue that a sixth has already been built --

The Quarter, a $60 million, 194-unit apartment building with ground-floor retail that opened earlier this year on Detroit Avenue at West 25th Street. The developer, Snavely, also bought the Forest City Savings and Trust Building across Detroit and is renovating it with 38 affordable apartments and a food hall for start-up restaurants.

Or, that a seventh major real estate development is under construction here --

Church+State, a $57 million, 161-unit apartment complex (one 11-story building and a six-story building) rising on Detroit, north of Church Avenue at West 29th (formerly State) Street. Hemingway Development is leading this project.

Others might say the above map omits an eighth major project that is actually a stimulus of several of the proposed big projects on the West Rim --

Irishtown Bend Park. This large park along and between the Cuyahoga River and West 25th, from Detroit Avenue south to Columbus Road, has amassed tens of millions of dollars in funding commitments. It will get built in some form over the coming years. But the full slate of proposed improvements to realize the vision for Irishtown Bend carries a price tag in the neighborhood of $100 million and will require more fundraising.

Point is, there is going to be a large park here. And quality public spaces draw residents and investments. The

West Side Market is one such quality public space -- an ethnic, European-style fresh food market house that has few equals in the USA. It is at least party responsible for two of the major developments planned at the southern flank of the valley, across from downtown Cleveland.

But the biggest factor in all of this is

Cleveland's improving job market. It is diversifying and growing at rates that rank it with the fastest-growing metropolitan-area economies in the USA. Plus, the two biggest demographic sectors in American history -- Millennials and Baby Boomers -- want to live in downsized housing in walkable urban settings that offer quality biking and public transit amenities.

So here are the five West Rim development sites and what is or may soon be happening there:

|

In 2019, Cuyahoga County may dispose of excess properties,

including the former County Engineer's office at the west end

of the Detroit-Superior Veterans Memorial Bridge (Google). |

Cuyahoga County Engineer's property -- If you've ever taken one of the subway tours in the lower deck of the Detroit-Superior/Veterans Memorial Bridge, then you've set foot on this 1.75-acre property. The entrance to the subway tour requires stepping across this land, owned and once used by the Cuyahoga County Engineer's office.

Not only does the engineer's office no longer use this property, but they're not even called the county engineer anymore. It's called the Department of Public Works and in 2014 it was consolidated along with many other county offices into the administration headquarters at East 9th Street and Prospect Avenue downtown.

So it, along with dozens of other properties countywide, has been deemed no longer essential to the operation of county government after

a year-long analysis by the county's real estate advisor,

Allegro Realty Advisors Ltd. The six-parcel county engineer's site will likely be the subject of an open-bid Request For Proposals by the county in early-2019.

However, a number of details about its disposition are not yet known, including if the six parcels will be sold individually or as a package, and if the county will seek to vacate the unused right of way of Superior Viaduct that separates parcel 00315046 from the other five county parcels. Or will that be up to the winning bidder to pursue? Either way, vacating this right of way will cause this land to be absorbed by the adjoining parcels, regardless of who owns them.

Questions about the disposition of the county engineer's property, directed at the county's Public Works Public Information Officer Koula Celebrezze, were referred to Damon Taseff who is heading up Allegro's county real estate advisor team. He said more details about this site will be publicly available very soon.

"I will be able to speak to more of this (disposition) in the coming weeks," Taseff wrote in an e-mail.

|

The Cuyahoga County Engineer's site which, if redeveloped,

could offer commanding views of Downtown Cleveland,

Irishtown Bend Park and the Cuyahoga valley (Google). |

The county engineer's property is in a prime location for a major development. The Quarter apartment complex was built on 2 acres -- only slightly larger than this site (if the unused part of old Superior Viaduct is vacated).

And just east of the county's land is Stonebridge, a multi-structure mixed-use complex built in the early 2000s. Its closest building to the county engineer's site is an 11-story condominium building called Stonebridge Waterfront but is set on land lower in elevation. So a similarly sized building (or taller) on the county's land would tower over it and offer amazing views of downtown Cleveland, Irishtown Bend Park and the Cuyahoga Valley.

|

Downtown Ventures' proposed mid-rise apartment building at

2210 Superior Viaduct would be comparable in height to the

neighboring Stonebridge Waterfront building. Also visible is

the County Engineer's property, seen just above the massing

for 2210 Superior Viaduct (CityArchitecture). |

2210 Superior Viaduct-Kertesz -- Daryl Kertesz's Downtown Ventures LLC paid $350,000 in June 2016 for a small industrial building at 2210 Superior Viaduct a short distance from the county engineer's site. Activity Capital, an investor group led by Kertesz, has proposed to replace the small industrial structure with a 64-unit apartment building perhaps 11 stories tall. He chose that height because it would come up to the 115-foot restriction for the current zoning height district. But Kertesz said he would like to get a variance and build up to 20 stories if the market allows for it.

Kertesz's

conceptual designs for the project won approval from Cleveland Planning Commission's Design Review Committee. But that was nearly three years ago in February of 2016. Kertesz said he was attracted to the Detroit-West 25th intersection due to residential momentum in the area. That includes Stonebridge and the newly completed The Quarter, as well as traffic calming improvements to the intersection to enhance pedestrian safety.

"It's still an active project," Daryl Kertesz said in a phone interview. "It just has to be the right project. There's a lot going on in that area and I'm not sure if more of the same (Class A multi-family) over there is the right answer given the market saturation. We will only get one bite at the apple and when we have the right project, we will pull the trigger."

If the county engineer's site is developed, it may further boost the area as an attractive, high-density urban neighborhood or it could over-saturate it. Nearby is Lakeview Terrace public housing, including the 19-story, 204-foot Lakeview Tower built in 1973. But now the area is attracting residents with more disposable income that should attract more retailers, restaurants, so-called "Creative Class A" loft offices and jobs to the north end of Ohio City. It remains to be seen if that could, in turn, nurture a feedback loop of attracting more residents.

|

The 5-acre, 530-space Lutheran Hospital parking lot will offer

an unobstructed view of Downtown Cleveland when buildings

on the east side of West 25th Street are demolished for the new

Irishtown Bend Park (Google). |

Lutheran Hospital parking/Weston -- While many urbanists lament the parking craters downtown, there is a large crater in Ohio City too. The 5-acre Lutheran Hospital surface lot acts like a moat between the long-established neighborhood around the West Side Market to the south and the emerging Detroit-West 25th intersection to the north.

The property has gained greater prominence with the development of Irishtown Bend Park, as well as the impending demolition of several buildings on the east side of West 25th. Front Steps Housing and Services will move by 2020 to its new address in the 2500 block West 25th. Its old facility at 1545 W. 25th will be demolished as will the abandoned, three-story, eight-unit Riverview Family Estates, 1505-1525 W. 25th. (not to be confused with the 15-story, 498-unit Riverview Tower, 1745 W. 25th.).

Once those buildings are gone, Lutheran Hospital's main parking lot or whatever development that may someday replace it will have a tremendous view of downtown and be right across the street from the new 20-acre hillside park. City Planning Commission's vision, per a rezoning done a few years ago, is for ground-floor retail along West 25th topped by multi-story buildings. To ensure enough parking remains, a significant parking deck would be needed.

There may be real interest in a development in that area. A company recently bought a half-acre of land at 1550 W. 25th that's surrounded by the Lutheran Hospital parking lot. On that small parcel is a former auto parts supply house that was bought in October 2017 for $435,000.

The buyer was I.B. Development LLC, which was registered with the state on Sept. 19, 2017 by Nadine Ezzie. She was general counsel for national real estate developer Weston at the time and the filing listed Weston's Warrensville Heights' address. Two other companies were also registered at about the same time with similar names, including Weston-I.B. Development, LLC and AK My Place I.B. Development LLC.

|

Clinton West Apartments are at left (the upside-down U-

shaped roof) and The Vine luxury townhouses are to their

right, or west (apartments.com). |

My Place Homes was founded by Chad Kertesz (cousin to Daryl Kertesz) in 2010 and has been developing housing in Ohio City. That includes

The Vine townhomes, a joint venture among Kertesz family members and their respective companies, rising on Vine Court at West 32nd. It is just west of the 70-unit

Clinton West apartments, a project My Place developed with the Geis family in 2017. Crain's Cleveland Business

reported in June that My Place Homes is a partner in I.B. Development with an unidentified national developer. But the state registrations show that developer is Weston.

"It's too early in pre-development to talk about it (the West 25th site plans) in detail," Chad Kertesz said to Crain's. He didn't respond to an e-mail request for an interview prior to publication.

A challenge for any future development here will be securing at least $20 million for a large parking garage to replace Lutheran Hospital's 530-space surface lot. South of Franklin Boulevard, two additional surface lots front West 25th and serve the hospital as well as the Cinecraft Building. They contain another 220 spaces. It is unlikely the hospital would pay for a new parking deck because they are not causing the change to the parking situation.

One funding possibility is to use tax-increment financing to secure a loan from a public sector partner, such as a port authority or from the U.S. Department of Transportation which offers

Transportation Infrastructure Financing & Innovation Act (TIFIA) loans, credits and guarantees for transit-oriented developments near rail and bus rapid transit stations. This development is on the Greater Cleveland Regional Transit Authority's

MetroHealth Line BRT-lite.

While local officials hope that many visitors will access the Irishtown Bend Park via walking, biking and transit, larger events will require a large parking facility. So while a new parking deck could serve Lutheran Hospital by day, it could also serve a new real estate development and the park in the evening and at night.

|

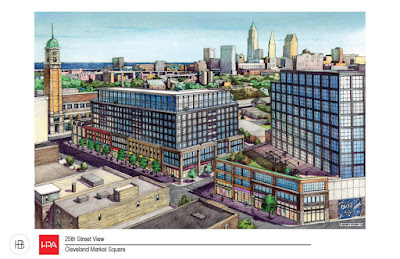

| Harbor Bay's Market Square development (HPA) |

Market Square-Harbor Square REA -- Look for the existing strip shopping center called Market Plaza at Lorain Avenue and West 25th to be demolished in Fall 2019. Following that, Chicago-area Harbor Bay Real Estate Advisors hopes to start construction on

Market Square, a 3-acre development at West 25th Street and Lorain Avenue with a 12-story office building, 10-story apartment building, ground-floor retail and a 550+ car parking deck just above the west side of the Red Line tracks.

The reason why this development is moving forward is due to the persistence of Cleveland-area native Dan Whalen who is director of Harbor Bay. Whalen encouraged his employer, which builds major projects around public transportation in the Midwest, to look at Cleveland and, specifically, Ohio City. The project site is next to the Ohio City Red Line rail station.

A new feature may be added to the project's plans -- a walkway from Columbus Road and the rail station to Market Square. This development will be similar in height to the United Bank Building across West 25th from the project site. That renovated building has attracted new office tenants and leads credence to the notion of attracting more to the Market District.

|

| Original plan for Brickhaus Towers/One Twenty West (HPA) |

One West Twenty-ex-Brickman -- It's possible that we may hear an announcement in 2019 regarding the former

Brickhaus Towers/One Twenty West development. This project was proposed by Andrew Brickman who has a lot on his plate already. There have also been reports that an investor withdrew from this project. Brickman scaled back his original plans for Brickhaus Tower to a smaller plan called One West Twenty.

Instead, a national developer is seeking to take over this site to deliver as many housing units as possible to the booming near-West Side. Sources asked that this developer not be named publicly as the company doesn't like to announce a project unless it is more than 90 percent certain the project will happen.

Word is that the new developer will likely go back to something similar to Brickman's original vision for this site -- a larger-scale mixed-use development with mid- to high-rise towers offering 500-600 apartments with ground-floor retail and live-work units facing Lorain. The new developer is not concerned about the scale of this project, citing increased interest by New York City investors in Cleveland and its newfound job growth.

If the larger-scale development is achieved, along with at least several of the others mentioned above, a number of substantial buildings will ring the West Rim of the Cuyahoga Valley in the coming years.

In addition to the 11-story Stonebridge Waterfront, 11-story Church+State, 19-story Lakeview Tower, 15-story Riverview Tower and the 10-story United Bank Building, we could soon see more big buildings here. The West Rim could see as many as six or seven large buildings in the five development sites discussed in this article. If so, Ohio City could have an impressive skyline for an urban neighborhood.

END