By Ken Prendergast

CLEVELAND – To anyone who follows real estate development news closely, you are allowed to be surprised by the scale and intensity of development occurring in the cores of our largest cities. And one of the biggest turnarounds anywhere in the USA is occurring in Cleveland.

What's even more amazing is that we're just starting a potentially major shift in housing and lifestyle choices to one that is decidedly more urban. True, Cleveland is jumping into it in a big way as you probably have noticed and which I will soon describe. But Cleveland has only scratched the surface on tapping a market that is in transition.

That may be hard for some to grasp as a dozen downtown buildings taller than 10 stories are already getting renovated into apartments, hotels and/or commercial space. And half of those buildings are taller than 20 stories. A few are mostly vacant, obsolete office buildings but others are at least half-occupied with offices. Nearly 700,000 square feet of offices will be on the move in the coming years, hopefully staying downtown in other existing buildings or possibly in a new building or two.

This flurry doesn't include new construction such as the 31-story Hilton Hotel, or the next phases of Flats East Bank, or a mixed-use neighborhood on the lakefront, or Brickhaus' Ohio City Townhomes, or Cedar Extension's redevelopment, or major improvements to FirstEnergy Stadium and Progressive Field, or the remaking of Public Square, or a new walkway linking downtown to the lakefront.

All of that construction and more has pushed Cleveland into the tops of national rankings of new construction jobs added in the past year. The Associated General Contractors (AGC) of America reported this summer that, out of 339 metro areas nationwide, only eight added more construction jobs than the 5,300 added in Greater Cleveland between June 2013 and June 2014. Some general contractors in Greater Cleveland reported that they have increased wages and upgraded benefit plans to attract and retain skilled construction workers, ACG reported in its Sept. 8, 2014 Data Digest.

The question many are asking: how long can this last?

First, consider the snowball effect. It rolls down a slope, gathers momentum and gets larger in the process. The same thing appears to be happening in Cleveland's center city, into which I will include Downtown, Ohio City, Tremont, Central and Asiatown. I debated whether to include University Circle, but chose not to since it is Ohio's fourth-largest employment center and therefore is big enough to stand on its own as an economic driver.

So each new or renovated residential building adds more purchasing power to the center city. That brings more restaurants, shops and amenities that attract new residents. New primary education schools are also popping up in the urban core. Here's an example of how the center-city market is flexing its muscles and absorbing more and more residents:

Marcus & Millichap's fourth-quarter 2013 Apartment Research Report showed that, among all the submarkets within Greater Cleveland (Cuyahoga, Lake and Lorain counties), Central Cleveland had the lowest vacancy rate at 2.5 percent AND commanded the highest average rent of $1,058. Lake County had the next-lowest vacancy rate of 3 percent while Beachwood/Mayfield had the next-highest rent of $926.

As more and more residential buildings opened in 2014, a funny thing happened – vacancy rates went down to 1.7 percent according to the Downtown Cleveland Alliance (DCA) in its August 2014 market report. And, most recently, the most luxurious building with the highest rents opened – The 9 in the former Ameritrust Tower. On the day the 29-story tower opened to new residents, the building was already 90 percent leased.

Similar development trends have occurred in Ohio City along West 25th Street, plus Detroit and Lorain avenues, where new and rebuilt buildings are offering hundreds of new residential units. Tremont continues to add mostly single-family residential homes, but now they're squeezing into the few vacant parcels left.

In Central, housing occupancy is at 96 percent and hundreds more housing units, including some market-rate housing, are coming thanks to the Cedar Extension development. And as Chinese and other Asian ethnic groups flood into America for college educations, Cleveland's Asiatown population has also grown.

Downtown's population has grown 88 percent since 2000, hitting an all-time high this year of 12,500 with more than 1,000 residential units under construction and another 1,100 units planned, DCA reports. Downtown's population will soon exceed 15,000 – larger than 32 of 57 Cuyahoga County municipalities.

Ohio City's population has stabilized at 9,200 residents as has Tremont at 8,000. Central is rebuilding its way past 12,400. While Asiatown, which comprises much of the officially named Goodrich-Kirtland Park neighborhood, saw its total population dip 5 percent since 2000 to 4,100. But its Asian population grew 14 percent, according to Census data. That's a core-city population of 37,000.

An even stronger downtown will lift surrounding neighborhoods. More residents means more purchasing power which means more jobs. The size of the growth still to come is potentially immense.

“A tsunami of young people and retiring Boomers has created demand not for three- and four-bedroom houses, but for smaller spaces,” said Scott Bernstein, president of Chicago’s Center for Neighborhood Technology, at the Sept. 12th annual meeting of the Northeast Ohio Areawide Coordinating Agency.

If national demographics apply to the Cleveland metro area, even if generally, then half of the metro's population is a potential customer for a center-city housing unit. How did I come to that conclusion?

Half of the nation's population is either a Baby Boomer (retiring & possibly downsizing) or a Millennial (more interested in “place” & technology, less into driving). But more so, a 2013 survey by the National Association of Realtors showed the nation roughly evenly split between those favoring smart growth, new-urbanist land uses (47 percent) vs. a single-family, detached home with a large yard (52 percent).

Although center-city rents are rising, they are still less than what is necessary to develop new-construction housing on prime downtown land without subsidies. Most residential units being added downtown are the result of converting obsolete office buildings that qualify for historic preservation tax credits from the state. Virtually all of downtown's obsolete office buildings have been converted, are under redevelopment or have plans to be converted. Once that supply runs out, rents may be high enough to support new construction without subsidies.

For that reason, downtown Cleveland is actually lagging behind many busier apartment markets. Developers would need to add 3,800 more units next year than currently are planned, according to Axiometrics, a Dallas-based apartment consultancy.

“I think the downtown residential rental market is severely undersupplied for a metropolitan area of this size,” said Scott Wolstein, a principal in Wolstein Group, as quoted in a Sept. 29, 2013 Crain's Cleveland Business article.

In the same article, “Developers jump on rental demand,” developer Ari Maron said that for a metropolitan area of 2.1 million, the central business district should possess at least 1 percent of the region's population – or 21,000 residents.

Indeed, developer Bob Stark, who is pursuing his new-construction nuCLEus development on a big parking lot at East 4th Street and Prospect Avenue, once said “it's not difficult to convince 1 percent of any group of people to do anything.” That was in reference to achieving the city's goal of 25,000 living downtown. He added that convincing the next 2 percent of people is even easier than convincing the first 1 percent, and the next 3 percent and so on. “It's an exponentially growing momentum,” Stark said.

Along with that growth comes more shopping options, including the 30,000-square-foot Heinen's grocery store at East 9th and Euclid Avenue that will open in February. More 24-hour restaurants and convenience stores will arrive. Someday there could be a City Target, a Staples, an Apple store or other options.

Each core-city neighborhood has room to grow to tap into the immediately available market within the metro area which is mobile and in a transition period in their lives. It doesn't mean that one of those core city neighborhoods will win the lion's share. It means that if downtown and its immediately surrounding neighborhoods go from being home to 0.5-1 percent of the metro population to up to 1-2 percent the metro population, then we're looking at 25,000 people downtown and another 75,000 people surrounding it.

And these areas won't just draw population from the metro area, but from the nation and the world. But there will be a shift in emphasis from suburban to urban. Why? Because it's already underway and there's no sign of it stopping.

END

Tuesday, September 16, 2014

Monday, June 30, 2014

Downtown Cleveland apartment conversions may drive demand for constructing a big office tower -- or two

Many older office buildings in downtown Cleveland are getting converted to apartments and other uses. How many? So many that ALL of the vacant office space may soon be gone -- and then some. So many that the time for constructing one or more major new office towers in the central business district is fast approaching.

In fact, by 2017, assuming that existing tenants in the older office towers relocate within downtown, there could actually be a shortage of leasable office space downtown. Typically, market pressure for a constructing a new office tower reaches a critical point when Class A (the most modern buildings) office vacancies drop below 10 percent and rents are rising.

a market report by real estate firm Jones Lang LaSalle. This includes absorption of space by office users at the new 21-story, 550,000-square-foot EY Tower at Flats East Bank. A second, but smaller office building measuring 220,000 square feet will soon rise across Front Street from the first tower. But that won't be anywhere near large enough to relieve the coming pressure for more office space.

Consider:

If those two buildings were renovated into residential (even partially), they would represent the fourth and fifth buildings downtown of 20 stories or taller to be converted since the Great Recession. The previous three were the Embassy Suites, old Ameritrust Tower, and the East Ohio Gas building. Embassy Suites was recently converted while the first apartments at Ameritrust Tower (will also include a Metropolitan Hotel) and East Ohio Gas Tower are almost ready for occupancy. Three vacant Class C office buildings of 10-19 stories (Schofield, 1010 Euclid and 1220 Huron) are also being renovated mostly for apartments.

Staff at the old Huntington Building say representatives of owner Optima 925 LLC have toured developers and investors through the building, including its world's largest bank lobby, with an eye toward adding apartments to a mix of office and retail uses. The amount of space that could be devoted to each use isn't yet known.

Furthermore, additional older Class C office buildings may be converted to apartments, soon. K&D Management LLC, Northeast Ohio's largest owner and manager of apartments, is finding the conversions of downtown office towers to housing so profitable that they are selling suburbans properties to buy more downtown buildings.

So if my math is correct, this could mean there will be more office users than office space left downtown -- assuming that all downtown office users relocate elsewhere within downtown. And it assumes there are no changes in absorption. Admittedly, those are both big "ifs."

But what isn't an "if" is that downtown's office market is about to become extremely tight, perhaps more than it's ever been. And the need for constructing one or more office towers downtown is about to reach a critical point.

Of course, the most visible location for an office tower is the west side of Public Square where a 60-story Ameritrust tower and hotel was to be built by the Jacobs Group. Buildings were leveled for the tower in 1990 but construction never started as Ameritrust merged with Society Corp. and moved into its new tower on the north side of Public Square. Society later merged with Key Corp. The west side of Public Square has remained a parking lot ever since. However there are rumblings that the Jacobs Group is rekindling plans for a new tower here.

END

In fact, by 2017, assuming that existing tenants in the older office towers relocate within downtown, there could actually be a shortage of leasable office space downtown. Typically, market pressure for a constructing a new office tower reaches a critical point when Class A (the most modern buildings) office vacancies drop below 10 percent and rents are rising.

a market report by real estate firm Jones Lang LaSalle. This includes absorption of space by office users at the new 21-story, 550,000-square-foot EY Tower at Flats East Bank. A second, but smaller office building measuring 220,000 square feet will soon rise across Front Street from the first tower. But that won't be anywhere near large enough to relieve the coming pressure for more office space.

Consider:

- There is currently nearly 14 million square feet of Class B (older buildings) and Class C (obsolete) office space downtown. Of that, 9.3 million square feet is Class B and 4.64 million square feet is Class C. Between Classes B/C, there is about 3.36 million square feet of office space that's vacant, or 24 percent. That's about 10.64 million square feet of tenants occupying Class B/C offices downtown.

- Between now and 2017, all the residential conversions on the books will reduce the downtown Class B/C office building supply to 9.34 million square feet (7 million in Class B, 2.34 million in Class C).

- That leaves about 1.3 million square feet of downtown office users looking for new digs. If they want to stay downtown, there's almost enough available space in the existing and planned Class A buildings (about 1.2 million square feet, which includes a second Flats East building) to accommodate them. Almost.

If those two buildings were renovated into residential (even partially), they would represent the fourth and fifth buildings downtown of 20 stories or taller to be converted since the Great Recession. The previous three were the Embassy Suites, old Ameritrust Tower, and the East Ohio Gas building. Embassy Suites was recently converted while the first apartments at Ameritrust Tower (will also include a Metropolitan Hotel) and East Ohio Gas Tower are almost ready for occupancy. Three vacant Class C office buildings of 10-19 stories (Schofield, 1010 Euclid and 1220 Huron) are also being renovated mostly for apartments.

Staff at the old Huntington Building say representatives of owner Optima 925 LLC have toured developers and investors through the building, including its world's largest bank lobby, with an eye toward adding apartments to a mix of office and retail uses. The amount of space that could be devoted to each use isn't yet known.

Furthermore, additional older Class C office buildings may be converted to apartments, soon. K&D Management LLC, Northeast Ohio's largest owner and manager of apartments, is finding the conversions of downtown office towers to housing so profitable that they are selling suburbans properties to buy more downtown buildings.

So if my math is correct, this could mean there will be more office users than office space left downtown -- assuming that all downtown office users relocate elsewhere within downtown. And it assumes there are no changes in absorption. Admittedly, those are both big "ifs."

But what isn't an "if" is that downtown's office market is about to become extremely tight, perhaps more than it's ever been. And the need for constructing one or more office towers downtown is about to reach a critical point.

Of course, the most visible location for an office tower is the west side of Public Square where a 60-story Ameritrust tower and hotel was to be built by the Jacobs Group. Buildings were leveled for the tower in 1990 but construction never started as Ameritrust merged with Society Corp. and moved into its new tower on the north side of Public Square. Society later merged with Key Corp. The west side of Public Square has remained a parking lot ever since. However there are rumblings that the Jacobs Group is rekindling plans for a new tower here.

END

Tuesday, November 5, 2013

It's time to stop ducking Duck Island

CLEVELAND – If it looks

like a big real estate development and sounds like a big real estate

development, it probably will be a big real estate development.

That's what a spate of real estate transactions in recent months suggest for an urban enclave close to downtown that's neither an island or named after ducks. (Some claim it's named for criminals who used to duck and hide here from the law). It's an ear-shaped area east of Columbus Road and west of the Walworth Run valley.

That's what a spate of real estate transactions in recent months suggest for an urban enclave close to downtown that's neither an island or named after ducks. (Some claim it's named for criminals who used to duck and hide here from the law). It's an ear-shaped area east of Columbus Road and west of the Walworth Run valley.

Duck Island is actually

part of Tremont although many people think it's in Ohio City. The

official dividing line for the service areas of the two community

development corporations (Ohio City Inc. and Tremont West Development Corp.) is Columbus Road.

Duck Island reappeared on

my radar Nov. 1 when the city's Design Review Committee was asked to approve a

request by Ward 3 Councilman Joe Cimperman to vacate part of West

20th Street north of Lorain Avenue.

Council members don't just

submit requests to vacate city streets when they feel like it. They

do so at the request of others. And vacating a city street means the

city is relinquishing its right of way, probably forever. It can be a

pretty big deal, and it often takes a big project to justify it.

At the north end of West

20th is a vacant, single-level industrial building that

was for sale for years. One year ago, it was acquired by Andrew

Brickman. He is a partner with Justin Campbell in Abode LLC which

builds eco-friendly, luxury town homes in Cleveland's University Circle and Little

Italy, plus the inner-ring suburbs Cleveland Heights, Fairview Park and Lakewood.

All around Brickman's industrial

parcel are numerous other residential and vacant properties having

different corporate owners. Yet all the names trace back to Brickman

or Abode in public records. Taken together, the properties west of

West 19th/Grove Court Condos and atop the hill east

of Columbus Road form a site about as large as the St. Ignatius High

School campus (or at least the main campus north of Lorain Avenue).

The purpose of this

agglomeration is not a secret. It is revealed in the name of one of

the companies formed to acquire land at the north end of Duck Island

– “Abode Ohio City Townhomes,” according to records from the

Cuyahoga County Auditor's office.

The timing of this project

is less well known; Brickman isn't talking publicly about this

project yet. However, considering that the city is already vacating a

street for it, this strongly suggests that demolitions and site

preparation could be sought soon. How many demolitions? Four commercial

structures are probable; but there are also 14 historic houses

sprinkled in this area and most appear to be in fair to good

condition. Their fates are unknown.

What is known are the

intentions of the developer eyeballing the area of Duck Island south

of Lorain Avenue. About 20 properties, most of them vacant land, were

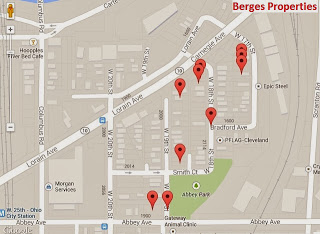

acquired by Matt Berges or his company Berges Home Performance. Ten of them are for development of green-friendly infill housing.

Plans for

various housing styles and property locations are shown on his firm's Web site.

Berges' motivations don't seem to be limited to the financial returns

that normally drive developers. Why? First, he is the green housing

manager at Environmental Health Watch. And second, he's invested in the

neighborhood in the ultimate way – he and his family moved there.

County

records show he recently acquired the large brick home and

surrounding 10 parcels of the late Rosemary Vinci. If that name

doesn't ring a bell, her name came up during early investigations of

the county's corruption scandal. Vinci died in 2008 under suspicious circumstances.

Her father, James Vinci, a reputed organized crime figure who famously owned

Diamond Jim's in the Flats, was reportedly killed in a mob hit in 1985 to

prevent him from testifying in a trial of accused mobsters.

But Rosemary

Vinci was better known in the neighborhood for owning strip clubs and

ruling the Duck Island Block Club with an iron high heel. One of her

missions was to urge Duck Island residents to acquire a neighboring

property and demolish the house on it (if it wasn't already torn

down) to reduce the urban density of the urban neighborhood located

just one mile from Public Square. She surrounded her own West 18th Street house by a moat of vacated lands and walls that exuded the kind of exclusive estate one expects in a gated suburban community.

A decade ago,

Vinci also led opposition to a mixed-income, high-density residential

development next to the Red Line Rapid station along Columbus Road

south of Lorain. She claimed the transit- and pedestrian-oriented development would increase traffic but others

accused her of fear-mongering against its low-income component.

Today, Berges is president of the Duck Island Block Club. He's a forward-thinking man who's highly regarded around the country and in Cleveland as a sustainable housing contractor.

With the booming demand by young professionals and empty-nesters for more housing in the urban core, it's important to have sustainability-minded developers like Brickman and Berges who are in a position to respond. It's a welcome change from the city's past when fear and corruption shaped our development policies.

With the booming demand by young professionals and empty-nesters for more housing in the urban core, it's important to have sustainability-minded developers like Brickman and Berges who are in a position to respond. It's a welcome change from the city's past when fear and corruption shaped our development policies.

Duck Island's location

between Ohio City and the heart of Tremont makes it an ideal urban

development area. Its proximity to the Rapid station and the

Lorain-Carnegie Hope Memorial Bridge with its new bikeway/walkway

into downtown enhances its drawing power. Hopefully Duck Island's new-urbanist promise shall be

hindered no more.

END

Wednesday, August 21, 2013

Enhance Clifton starts Sept 13, merchants fear traffic detours

CLEVELAND – Now that contractors were chosen for $25 million worth of transit and pedestrian enhancements to Clifton Boulevard, a formal groundbreaking ceremony is scheduled for Sept. 13.

But after the West Shoreway was closed for two weeks this past summer for the filming of Captain America, Clifton's merchants want to know how construction of Enhance Clifton will be carried out.

Those answers will start to come into focus now that the Greater Cleveland Regional Transit Authority's board on Tuesday hired Perk Company Inc. for $8.65 million to construct infrastructure along 4 miles of Clifton from the west end of Lakewood east to Edgewater Park.

That includes a landscaped median in Cleveland, improved transit waiting environments and a streetscape for the business district between West 115th and West 117th streets.

RTA's board also approved a contract with New Flyer of America Inc. to buy 23 articulated, low-floor buses for up to $16.33 million. An articulated bus is extra long and bends in the middle so it can go around corners and curves. Most of these new buses will be used on the No. 55 Clifton route into downtown, according to RTA documents.

The contract with Perk also stipulates that the City of Cleveland may provide an additional $343,026 for sidewalk repairs, said Ward 16 Councilman Jay Westbrook.

“The sidewalks will be replaced as needed under the city's assessment program that's been used in the rest of Ward 16 to maintain safe sidewalks,” Westbrook said.

The difference with the Clifton project is that property owners will have to pay only 50 percent of the cost instead of the full amount. He said property owners having sidewalks in need of repair or replacement should have already received assessment notices in the mail.

Until the filming of Captain America shut down the Shoreway for two weeks in June and detoured traffic away from Clifton, merchants seemed excited about Enhance Clifton. But that shut down caused some merchants to experience a 90 percent reduction in business, said Anita Brindza, executive director of Cudell Improvement Inc.

“Some elements of Enhance Clifton will be very much welcomed, but merchants justifiably have some trepidation,” she said. “It depends on how the construction goes. If they do it in segments, then it may not be as bad.”

“The sequencing and scheduling still have not been determined,” Westbrook said. “Clifton will remain open during construction. Some of the work will start in the fall, but most will be done starting in the spring.”

He also noted that this project is the forerunner of what is planned for the West Shoreway, which is due to be converted into a landscaped boulevard. A funding request for this conversion is pending before the Northeast Ohio Areawide Coordinating Agency.

###

But after the West Shoreway was closed for two weeks this past summer for the filming of Captain America, Clifton's merchants want to know how construction of Enhance Clifton will be carried out.

Those answers will start to come into focus now that the Greater Cleveland Regional Transit Authority's board on Tuesday hired Perk Company Inc. for $8.65 million to construct infrastructure along 4 miles of Clifton from the west end of Lakewood east to Edgewater Park.

That includes a landscaped median in Cleveland, improved transit waiting environments and a streetscape for the business district between West 115th and West 117th streets.

RTA's board also approved a contract with New Flyer of America Inc. to buy 23 articulated, low-floor buses for up to $16.33 million. An articulated bus is extra long and bends in the middle so it can go around corners and curves. Most of these new buses will be used on the No. 55 Clifton route into downtown, according to RTA documents.

The contract with Perk also stipulates that the City of Cleveland may provide an additional $343,026 for sidewalk repairs, said Ward 16 Councilman Jay Westbrook.

“The sidewalks will be replaced as needed under the city's assessment program that's been used in the rest of Ward 16 to maintain safe sidewalks,” Westbrook said.

The difference with the Clifton project is that property owners will have to pay only 50 percent of the cost instead of the full amount. He said property owners having sidewalks in need of repair or replacement should have already received assessment notices in the mail.

Until the filming of Captain America shut down the Shoreway for two weeks in June and detoured traffic away from Clifton, merchants seemed excited about Enhance Clifton. But that shut down caused some merchants to experience a 90 percent reduction in business, said Anita Brindza, executive director of Cudell Improvement Inc.

“Some elements of Enhance Clifton will be very much welcomed, but merchants justifiably have some trepidation,” she said. “It depends on how the construction goes. If they do it in segments, then it may not be as bad.”

“The sequencing and scheduling still have not been determined,” Westbrook said. “Clifton will remain open during construction. Some of the work will start in the fall, but most will be done starting in the spring.”

He also noted that this project is the forerunner of what is planned for the West Shoreway, which is due to be converted into a landscaped boulevard. A funding request for this conversion is pending before the Northeast Ohio Areawide Coordinating Agency.

###

Subscribe to:

Posts (Atom)