|

Uncertainty is the word describing the future of corporate office sizes,

locations and design in Cleveland in the post-pandemic era. There are

many things up in the air when it comes to that future. But every chal-

lenge has an opportunity, including designing offices to be more like

home or even building residential for employees next to or within new

office developments. One of Cleveland's best known office designers

is Vocon Partners. This is their new offices on Prospect Avenue in

Cleveland's MidTown neighborhood (officelovin.com).

CLICK IMAGES TO ENLARGE THEM |

UPDATED OCT. 10

The real estate market is divided into four basic end-users -- residential, hospitality, retail and office. Although the retail market has been shrinking for years, it is basically on hold during the pandemic with some exceptions. The hospitality market is pretty much in a coma but it will probably return healthy once it regains consciousness. Only the residential market has shown a great deal of resiliency throughout the pandemic.

And then there's the office market. If there ever was a period of uncertainty for any end-user market, it's the office sector.

You will also find some very strong feelings from some people about the future of the market, even though no one has seen the future. Yet, you will find some who are certain of what the future holds -- that notion of commuting to work in the morning, laboring in an office building all day, and then commuting back home in the evening is a pandemic fatality. "Or at least that's the way it should be, dammit!"

"Place-based work culture mattered before the pandemic, it matters now, and will matter post-pandemic," countered Downtown Cleveland Alliance Executive Vice President of Business Development Michael Deemer in an Oct. 10 tweet. "Endless screen time can’t match the productivity, collaboration, innovation, and mental health benefits that comes from in-person interaction."

The 3rd Quarter 2020 Cleveland office market report from Newmark Knight Frank takes a middle approach, especially when discussing the downtown Central Business District (CBD) market.

The Cleveland CBD is still considered a desirable location for prominent local, regional and national companies, though it is estimated that Downtown Cleveland has seen an 80 percent reduction of office workers during the pandemic. Office trends, such as unassigned seating, coworking and large "bullpens" of worker cubes, have companies rethinking safe reoccopation strategies, and leasing activity in the CBD from April through September was as sluggish as it has ever been. This past quarter's statistics already bear out that it might become more expensive to lease space in the future, especially at the Class A and B levels. As office employees will want to work from home more often, companies might considering (leasing) more space per person to keep germs from spreading. The outlook for the rest of 2020 is uncertain.

|

The biggest potential office development in Cleveland is the upcoming

announcement about Sherwin-Williams' new global headquarters down-

town. Word is that it could rival the height of Key Tower, Ohio's tallest

skyscraper. This is an official massing of the Sherwin-Williams HQ, as

seen in orange in the center of this image (Geowizical). |

And that's the one-word takeaway when it comes to the office market -- uncertain. Add to that the large number of companies that are prepared to make moves in the next year or so and you have a lot of pieces thrown up into the air. How and where they will land will be incredibly interesting to watch.

One of the largest companies that will be making a move is Sherwin-Williams. The 154-year-old company takes a long view towards its business. Its CEO John Morikis recently eased concerns about the possibility of having more of its office employees work from home and thereby shrinking the size of its new global HQ.

"We recognize that the development, engagement and sense of community our employees share has been essential to our success for more than 150 years and would be difficult to sustain over the long-term with a remote-based workforce," Morikis said.

There are more reports coming out about Sherwin-Williams' new HQ building on Public Square. NEOtrans reported that the HQ will be one of Cleveland's four tallest, reaching about 45-55 stories high. According to some suppliers, they were told by the HQ's construction manager Welty Gilbane that the new skyscraper could rival Key Tower. Morikis reportedly considers the new HQ's location and design as essential to attracting young talent to the company.

Another old and large Cleveland company, 173-year-old Cleveland-Cliffs, is also facing an office space crunch at its downtown Cleveland headquarters at 200 Public Square. It just bought two steelmaking firms larger than itself -- Cincinnati-area-based AK Steel and Chicago-based ArcelorMittal USA.

|

After Cleveland-Cliffs' recent buying spree, it may have become too

large to remain in its current headquarters in 200 Public Square. But

it is soon to know where its new home might land (Google).

|

Absorbing those two firms over the coming years will likely prompt the firm to move out of its crowded 46-story tower on Public Square. Where could Cleveland-Cliffs and its roughly 300,000 square feet of potential office space needs land? It will probably be a year or more before that question is answered.

The Newmark Knight Frank office market report noted two reasons why office needs might shrink (remote working) and why they might grow (social distancing). But neither of those may be enduring, long-term trends.

A trendsetting change that could endure is what CrossCountry Mortgage is seeking. Relocating its HQ to downtown Cleveland from the suburbs (Brecksville) isn't the trendsetting move. Many companies are going downtown to lure more young talent to their workforces. Recently, Goldwater Bank announced its move from Beachwood to downtown, shortly after digital marketer Fathom said it is moving from Valley View to the Flats.

The trendsetting move by fast-growing CrossCountry Mortgage is to add a residential component to its HQ plan for renovating several historic warehouse buildings on Superior Avenue in the East 20s. The apartments will be marketed first to HQ employees, according to a presentation to the city by Vocon Partners, architects hired by a joint venture led by CrossCountry Mortgage CEO Ron Leonhardt.

Imagine working from home but next door to your office building. It offers the productivity and collaboration benefits of working at the office while also giving employees the privacy of working from home -- with an incredibly easy commute regardless of the weather or traffic. The city and CrossCountry are finalizing a deal for $2 million in public incentives for the first phase of the six-acre development.

|

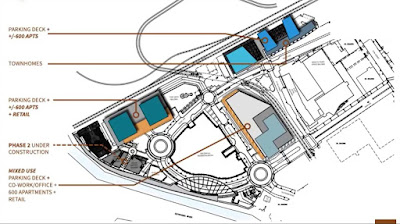

Site plan of the proposed first phase of CrossCountry Mortgage's

new Cleveland headquarters. North is to the left in this image, as

is Superior Avenue with Payne Avenue to the right and East 21st

Street at the bottom. The shaded building to the lower left will

be converted into apartments and marketed first to company em-

ployees. The rest of the site is comprised of historic warehouses

to be converted into offices for 700 workers (Tyler Kapusta). |

Although the Dodge Reports say renovation work may not begin until 2022, a four-story brick building at 2110 Superior Ave. is due to become a 40-unit apartment building. The first phase of CrossCountry Mortgage's offices for about 700 employees will be along East 22nd Street in the former warehouses of Tap Packaging Solutions (ex-Chilcote Co.). Tap is a 108-year-old firm that moved its 125 jobs to Brooklyn. Construction on the office component is due to start early next year.

But CrossCountry Mortgage is in growth mode. That 700-employee figure is restrained from growing faster by the firm's small offices in Brecksville as well as by its lack of suburban marketability to younger people. In five years, after the move to larger offices in downtown Cleveland, the company expects to have 2,000 employees, according to a CrossCountry executive who spoke off the record.

Like Cleveland Cliffs, a growing Benesch, Friedlander, Coplan & Aronoff LLP is also looking to move out of 200 Public Square. Unlike Cleveland Cliffs, it knows where it wants to go -- the 25-story nuCLEus office tower proposed on a huge parking lot on East 4th Street in the Gateway District by a partnership of Stark Enterprises and J-Dek Investments. Benesch wants to be nuCLEus' anchor tenant.

Unfortunately, nuCLEus doesn't have enough office tenants yet for Stark to get a construction loan and start work. It's not for a lack of potential tenants sniffing around. Word is that at least two medium-sized tenants now at one downtown building are considering relocating to nuCLEus. Together, the two potential tenants would be a little larger than Benesch's 300 employees. But "potential" isn't nuCLEus' problem -- it's about getting enough tenants signed.

Additionally, keep an eye on Erieview Tower whose new owner James Kassouf and partners are converting 13 of the office building's 40 floors to residential. Law firm Weston Hurd LLP is moving to AECOM Centre across East 9th Street. And it probably won't be the only defection from Erieview. Look for more big tenants to step out and invest in new digs -- including possible new construction.

|

Between law firm Benesch and development firm Stark, the

proposed 340,000-square-foot nuCLEus office tower has about

200,000 square feet of space spoken for. But that's not enough

for Stark Enterprises to start construction. Reportedly, there

are potential office tenants considering locating at nuCLEus

that are large enough to trigger its construction (Stark).

|

Increasingly, downtown tenants want to be in trophy-class buildings -- not just Class A. They want top-notch finishes and technology. They want reserved spaces for executives under the same roof as their offices. They want fitness rooms and quiet, comfortable outdoor decks to think and/or decompress. And they want their company's name and logo to be on the outside and inside of the building for everyone to see. Or at least that's what real estate brokers and developer say prospective clients are telling them.

Going back to the suburbs, this time in North Olmsted, two companies are hunting for new space. The largest is Moen Inc. USA which has outgrown its 27-year-old, 141,221-square-foot office building at Interstate 480 and Great Northern Blvd. But it hasn't outgrown its 16.5-acre property, only two-thirds of which is developed and most of that is for surface parking.

More than 600 people work at Moen's North Olmsted offices which have expanded into leased office spaces along Country Club Boulevard on the other side of I-480. According to sources, Moen is looking at new construction in Greater Cleveland and elsewhere for its expanded U.S. HQ. Its landing spot is far from settled.

In the meantime, Moen will renovate its existing building to become COVID-compliant. Moen reportedly is eager to get its employees back in the office. How many more companies are similarly eager to get their employees back in the fold and what are they willing to do to achieve that?

Also in North Olmsted, FM Global, a Providence, RI-based insurance firm, is looking for a more urban setting for its 90-plus employees. It was ready to relocate to One Lakewood Place until Carnegie Management and Development Corp. walked away from the project. The city reached a settlement with Carnegie and will consider a new developer. FM Global has put its office search on hold during the pandemic.

|

Moen Inc. USA's headquarters in North Olmsted has more than 600

employees. The company has outgrown this building on the south

side of Interstate 480 and expanded into leased offices on the

north side of the highway. Company officials are reportedly

looking into expanding the existing building or possibly

constructing a new headquarters elsewhere (Google). |

So has AmeriGas Partners L.P., which was recently acquired by UGI. As part of a corporate restructuring, AmeriGas considered tripling the number of its jobs here in Greater Cleveland to more than 300. Its offices are located in Westlake and more space has been added in Brooklyn Heights. But the jobs increase is far less than what was planned before the pandemic. In the future, AmeriGas' actions are worth watching.

On the other side of town, Beachwood-based Tremco Inc., a 92-year-old manufacturer of sealants, would like to unite its two east-side manufacturing plants and possibly its suburban headquarters into the same facility. To stay close to its existing workforce, Tremco could be a candidate for relocation to the Opportunity Corridor. But no site has been decided, yet.

The wildcard for some of the office moves around town is the completely vacant, former headquarters of Ameritech built in 1983. Called The Ellipse and located at 45 Erieview Plaza (corner of East 9th Street and Lakeside Avenue) in downtown Cleveland, the 16-story, 496,000-square-foot building was the subject of an August auction. The building has been difficult to lease because its floorplates are large, averaging 31,000 square feet.

An unidentified buyer won the auction and the chance to pay a mere $14.9 million for the property, according to a source. But the buyer walked away during the due-diligence period prior to taking title. It is not known why the purchase did not go through.

The current owner, New York City-based private equity firm Somera Road, is back to square one in its disposition of the office building and attached parking garage. Somera Road bought the property in 2016 for $36 million nine years after MB Cleveland Erieview LLC acquired it for $53 million.

END